Wealth accumulation strategies are like the hidden gems of the finance world, paving the way for a journey filled with opportunities and growth. Get ready to dive into a world where smart choices lead to financial abundance and long-term prosperity.

In this guide, we’ll explore the ins and outs of wealth accumulation strategies, from understanding the concept to delving into different types and factors to consider. So, buckle up and let’s navigate the path to financial success together.

Overview of Wealth Accumulation Strategies

When it comes to building wealth, having a solid plan in place is crucial. This is where wealth accumulation strategies come into play.

These strategies are specifically designed methods or approaches to help individuals grow their wealth over time, typically through investments, savings, and other financial vehicles.

Importance of Wealth Accumulation Strategies

Wealth accumulation strategies are important because they provide a roadmap for individuals to achieve their financial goals. Without a clear plan, it can be easy to aimlessly save money without any real direction.

Having a well-defined strategy helps individuals stay focused, disciplined, and motivated to continue growing their wealth over the long term.

Differences from Traditional Saving Methods

- Wealth accumulation strategies go beyond traditional saving methods by incorporating investment opportunities to help grow wealth at a faster rate.

- While traditional saving methods focus on putting money away in a savings account, wealth accumulation strategies involve diversifying investments across various asset classes.

- Additionally, wealth accumulation strategies often involve risk management techniques to protect and grow wealth in a more efficient manner.

Types of Wealth Accumulation Strategies

Passive income strategies involve earning money with little to no effort on your part, such as rental income, dividends from investments, or royalties from creative work. On the other hand, active income strategies require your ongoing participation, like running a business or working a traditional job.

Investment-Based Wealth Accumulation Strategies

- Stock Market Investments: Buying shares of publicly traded companies with the expectation of price appreciation and dividends.

- Real Estate Investments: Purchasing properties to generate rental income or profit from appreciation.

- Bonds: Loaning money to governments or corporations in exchange for regular interest payments.

Differences Between Long-Term and Short-Term Wealth Accumulation Strategies

- Long-Term Strategies: Focus on gradual growth over an extended period, often involving investments with lower risk but higher potential returns.

- Short-Term Strategies: Aim for quick profits within a shorter timeframe, typically through higher-risk investments or trading strategies.

- Example: Long-term strategies may include retirement savings accounts like 401(k)s, while short-term strategies could involve day trading in the stock market.

Factors to Consider in Wealth Accumulation

When it comes to building wealth, there are several key factors to consider that can significantly impact your overall financial strategy. Understanding these factors can help you make informed decisions and maximize your wealth accumulation efforts.

Risk Tolerance in Choosing Wealth Accumulation Strategies

Risk tolerance plays a crucial role in determining the appropriate wealth accumulation strategies for an individual. It refers to your willingness and ability to withstand fluctuations in the value of your investments. Those with a higher risk tolerance may opt for more aggressive strategies that offer potentially higher returns but come with increased volatility. On the other hand, individuals with a lower risk tolerance may prefer more conservative approaches that prioritize capital preservation over growth.

The Impact of Inflation on Wealth Accumulation Strategies

Inflation is another important factor to consider when devising wealth accumulation strategies. Over time, inflation can erode the purchasing power of your money, making it essential to account for this when planning for the future. To combat the effects of inflation, it’s crucial to invest in assets that have the potential to outpace inflation and preserve the real value of your wealth.

Diversification in Effective Wealth Accumulation

Diversification is a key principle in effective wealth accumulation that involves spreading your investments across different asset classes to reduce risk. By diversifying your portfolio, you can minimize the impact of negative performance in any single investment and potentially enhance overall returns. This strategy helps to protect your wealth from specific market risks and ensures a more balanced and resilient financial position.

Real Estate as a Wealth Accumulation Strategy

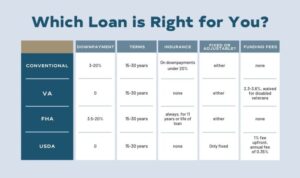

Real estate investment can be a lucrative wealth accumulation strategy due to the potential for long-term appreciation and passive income generation. By investing in properties such as rental homes, commercial buildings, or land, individuals can build wealth over time through equity growth and rental income.

Benefits and Challenges of Real Estate Wealth Accumulation

Investing in real estate offers several benefits, including:

- Appreciation: Properties tend to increase in value over time, allowing investors to build equity.

- Passive Income: Rental properties can generate monthly income through rent payments.

- Tax Advantages: Real estate investors can benefit from tax deductions, depreciation, and other incentives.

However, there are also challenges to consider, such as:

- Market Volatility: Real estate markets can fluctuate, impacting property values and rental income.

- Maintenance Costs: Property maintenance and repairs can eat into profits.

- Liquidity: Real estate is not as easily converted to cash compared to other investments.

Successful Real Estate Wealth Accumulation Strategies

Examples of successful real estate wealth accumulation strategies include:

- Buy and Hold: Purchasing properties at a good price and holding onto them for long-term appreciation and rental income.

- House Hacking: Living in one unit of a multi-family property while renting out the others to cover mortgage costs.

- Fix and Flip: Buying properties below market value, renovating them, and selling for a profit.