As Types of life insurance takes center stage, this opening passage beckons readers with american high school hip style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Get ready to dive into the world of life insurance, where we break down the different types and help you navigate the complex landscape of financial security.

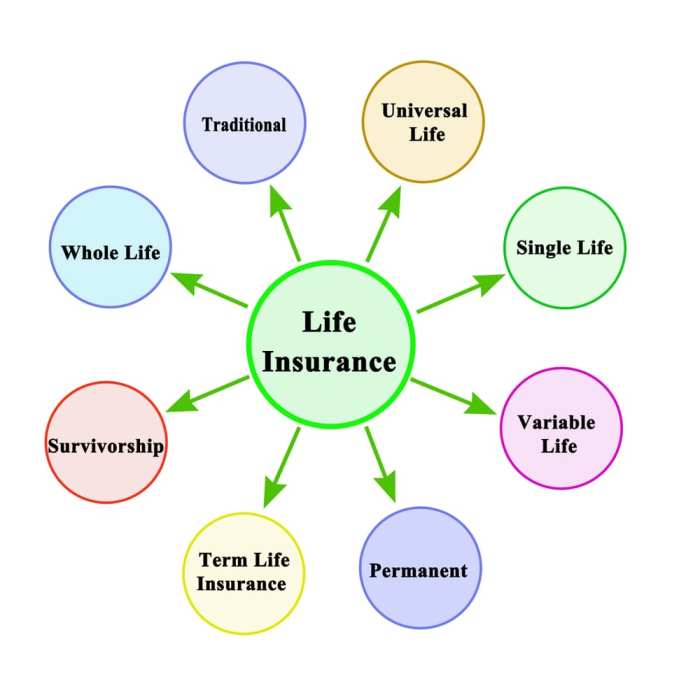

Types of Life Insurance

Life insurance comes in various forms to cater to different needs and preferences. Let’s break down some of the most common types:

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. It offers a death benefit to the policyholder’s beneficiaries if the insured passes away during the term. This type of insurance is more affordable compared to other options and is a popular choice for those looking for temporary coverage.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the entire lifetime of the insured. In addition to the death benefit, it also accumulates cash value over time, which can be borrowed against or withdrawn. The premiums for whole life insurance are typically higher than term life insurance but offer lifelong protection.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that allows the policyholder to adjust the death benefit and premiums as needed. It combines a death benefit with a cash value component that earns interest based on market performance. This type of insurance offers more flexibility in terms of premium payments and coverage adjustments.

Variable Life Insurance

Variable life insurance is another type of permanent life insurance that allows the policyholder to allocate cash value into various investment options such as stocks, bonds, and mutual funds. The cash value and death benefit of variable life insurance can fluctuate based on the performance of the chosen investments. This type of insurance carries more risk but also offers the potential for higher returns compared to other types.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period of time, known as the “term.” This type of insurance offers a death benefit to the beneficiaries if the insured individual passes away during the term of the policy. Term life insurance is often chosen for its affordability and simplicity compared to other types of life insurance.

Characteristics and Benefits

- Term lengths typically range from 10 to 30 years, providing flexibility for individuals to choose a term that aligns with their financial obligations and needs.

- Premiums for term life insurance are generally lower compared to permanent life insurance policies, making it an attractive option for those on a budget.

- Term life insurance offers a straightforward death benefit, providing financial protection for loved ones in the event of the insured’s death.

- Policyholders have the option to convert their term life insurance policy into a permanent life insurance policy, offering flexibility for changing needs.

Typical Term Lengths

In term life insurance policies, individuals can typically choose term lengths of 10, 15, 20, or 30 years. The chosen term length determines how long the coverage will last and how long the premiums will remain consistent. Shorter-term lengths may have lower premiums, while longer-term lengths may offer more extended coverage but with higher premiums.

Premium Determination

Premiums for term life insurance are determined based on several factors, including the insured individual’s age, health condition, lifestyle, coverage amount, and chosen term length. Younger, healthier individuals typically pay lower premiums, while older individuals or those with health issues may have higher premiums.

Scenarios for Term Life Insurance

Term life insurance may be the most suitable option for individuals who need coverage for a specific period, such as to protect their family during their working years, cover a mortgage, or pay off debt. It can also be a good choice for individuals on a budget who want to ensure financial protection for their loved ones.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured. Unlike term life insurance, which only covers a specific period, whole life insurance offers a guaranteed death benefit as long as the premiums are paid.

Key Features of Whole Life Insurance

Whole life insurance has the following key features:

- Provides coverage for the entire lifetime of the insured.

- Builds cash value over time.

- Offers a guaranteed death benefit.

- Premiums remain level throughout the life of the policy.

Cash Value Component of Whole Life Insurance Policies

The cash value component of whole life insurance policies is a savings component that grows over time. A portion of the premium paid goes towards the cash value, which accumulates on a tax-deferred basis. Policyholders can access this cash value through loans or withdrawals.

Dividends in Relation to Whole Life Insurance

Some whole life insurance policies pay dividends to policyholders. Dividends are a portion of the insurance company’s profits that are distributed to policyholders. Policyholders can choose to receive dividends in cash, use them to reduce premiums, purchase additional coverage, or allow them to accumulate interest.

Situations Where Whole Life Insurance is Beneficial

Whole life insurance is beneficial in the following situations:

- Providing lifelong financial protection for dependents.

- Building cash value for future financial needs.

- Estate planning and wealth transfer.

- Tax-deferred growth of cash value.

Universal Life Insurance

Universal life insurance policies offer a unique combination of flexibility and benefits for policyholders. Unlike term life insurance, which provides coverage for a specific period, universal life insurance allows for adjustments to premiums and death benefits over time. This type of policy is designed to provide lifelong coverage while also accumulating cash value.

Flexibility of Universal Life Insurance

Universal life insurance policies offer flexibility in premium payments, allowing policyholders to adjust the amount and frequency of payments based on their financial situation. Additionally, the death benefit can be modified to meet changing needs, providing an adaptable solution for long-term financial planning.

Pros and Cons of Universal Life Insurance

- Pros:

- Flexible premium payments

- Ability to adjust death benefit

- Accumulation of cash value

- Cons:

- More expensive than term life insurance

- Complexity in understanding policy features

- Interest rates can impact cash value growth

Interest Rates and Universal Life Insurance

Interest rates play a crucial role in universal life insurance policies as they affect the growth of the cash value component. Higher interest rates can lead to increased cash value accumulation, while lower rates may result in slower growth. Policyholders should consider the impact of interest rates when evaluating the performance of their universal life insurance policy.

Advantages of Choosing Universal Life Insurance

- For individuals seeking lifelong coverage

- For those looking for flexibility in premium payments and death benefits

- As a way to accumulate cash value over time

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that combines a death benefit with an investment component. Unlike traditional whole life insurance, the cash value of a variable life insurance policy can fluctuate based on the performance of the investment options chosen by the policyholder.

Investment Component of Variable Life Insurance

Variable life insurance allows policyholders to allocate their premiums among a variety of investment options such as stocks, bonds, and mutual funds. The cash value of the policy can grow based on the performance of these investments. Policyholders have the potential to earn higher returns compared to other types of life insurance, but they also bear the investment risk.

Risks Associated with Variable Life Insurance Policies

One of the main risks of variable life insurance is the volatility of the investment component. If the chosen investments underperform, the cash value of the policy may decrease, impacting the death benefit and potentially requiring additional premium payments to keep the policy active. Policyholders must actively manage their investment choices to mitigate these risks.

Comparison with Other Types of Life Insurance

When compared to traditional whole life insurance, variable life insurance offers the potential for higher returns due to the investment component. However, it also comes with greater risk and requires a more hands-on approach to managing investments. In terms of potential returns, variable life insurance falls between term life insurance and whole life insurance, offering a balance of protection and growth potential.

Individuals Who May Benefit from Variable Life Insurance

Variable life insurance may be suitable for individuals who have a higher risk tolerance and are looking for the opportunity to grow their cash value through investments. Business owners, high-income earners, or individuals with complex financial needs who can afford the premiums and are comfortable with market risk may find variable life insurance beneficial in building wealth and providing a financial legacy for their beneficiaries.