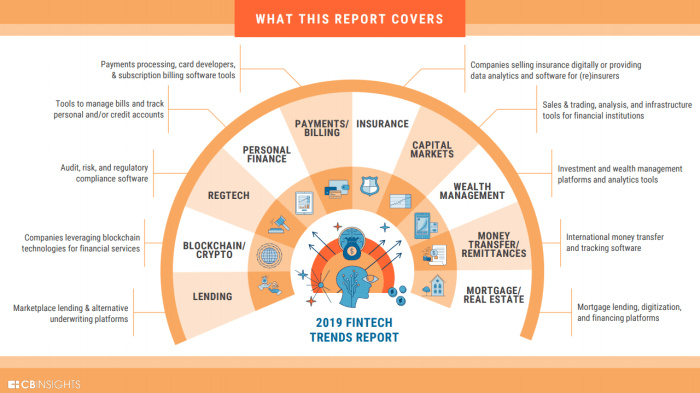

Diving into the world of financial technology (fintech), we uncover the latest trends that are reshaping the industry landscape. From revolutionary technologies to evolving regulations, this overview delves into the dynamic realm of fintech innovation.

As we navigate through the intricacies of fintech trends, we unravel the impact of emerging technologies, digital payments, personal finance management, and regulatory challenges that are shaping the future of financial services.

Overview of Fintech Trends

Fintech, short for financial technology, has revolutionized the way we interact with money and financial services. It combines innovative technology with financial services to make transactions more efficient, convenient, and accessible to a wider audience.

Brief History of Fintech

Fintech has been around longer than you might think. It first gained traction in the 1950s with the introduction of credit cards. Since then, the industry has evolved rapidly with the rise of the internet and digital technologies, giving birth to online banking, mobile payments, peer-to-peer lending, and cryptocurrencies.

Key Drivers of Fintech Growth

The growth of fintech can be attributed to several key factors, including advances in technology, changing consumer behavior, regulatory support, and increased demand for personalized financial services. The use of artificial intelligence, blockchain, and big data analytics has also played a significant role in driving innovation within the fintech space.

Impact of Fintech on Traditional Financial Services

Fintech has disrupted traditional financial services by offering more efficient, cost-effective, and user-friendly solutions. Banks and financial institutions are now facing increased competition from fintech companies that are able to provide better customer experiences, faster transactions, and more innovative products. This has forced traditional players to adapt and embrace technology to stay relevant in the rapidly changing financial landscape.

Emerging Technologies in Fintech

Artificial intelligence, blockchain, and decentralized finance are revolutionizing the financial industry, bringing about significant changes and opportunities for innovation.

Artificial Intelligence in Fintech

Artificial intelligence plays a crucial role in fintech by enhancing customer experience, automating processes, and improving decision-making. AI-powered chatbots, personalized recommendations, and fraud detection systems are just a few examples of how AI is transforming financial services.

Blockchain Transformation

Blockchain technology is reshaping the financial industry by providing secure and transparent transactions. The decentralized and distributed ledger system ensures trust and eliminates the need for intermediaries. Smart contracts, digital identities, and cross-border payments are some of the ways blockchain is revolutionizing finance.

Decentralized Finance (DeFi)

Decentralized finance, or DeFi, is a rising trend that aims to create an open and accessible financial system without traditional gatekeepers. DeFi platforms leverage blockchain technology to offer services such as lending, borrowing, and trading without the need for centralized authorities. The rise of DeFi has the potential to democratize finance and provide financial inclusion to underserved populations.

Digital Payments and Mobile Banking

As financial technology continues to evolve, one of the key areas of focus is digital payments and mobile banking. These innovations have revolutionized the way we conduct financial transactions, offering convenience and efficiency to users.

Shift towards Digital Payments

The shift towards digital payments has been driven by the increasing use of smartphones and the internet. Consumers now prefer the convenience of making payments online or through mobile apps, rather than using cash or physical cards.

Mobile Banking Solutions

Various fintech companies have introduced mobile banking solutions to cater to the growing demand for digital financial services. These solutions offer features such as account management, fund transfers, bill payments, and even investment options, all accessible through a mobile device.

Security Challenges in Digital Transactions

While digital payments and mobile banking offer convenience, they also come with security challenges. Cyber threats such as phishing scams, identity theft, and data breaches pose risks to users’ sensitive financial information. Fintech companies need to continuously enhance their security measures to protect against these threats and ensure the safety of digital transactions.

Personal Finance Management

Personal finance management has been revolutionized by fintech, making it easier for individuals to track their expenses, create budgets, and make informed investment decisions. With the rise of innovative technologies, managing personal finances has become more accessible and convenient than ever before.

Popular Budgeting and Investment Apps

- Mint: One of the most popular budgeting apps that allows users to track their spending, create budgets, and set financial goals.

- YNAB (You Need A Budget): Focuses on helping users allocate every dollar they earn towards specific financial goals, providing a comprehensive approach to budgeting.

- Acorns: A micro-investing app that automatically invests spare change from everyday purchases into diversified portfolios, making investing simple and effortless.

Benefits of Robo-Advisors for Financial Planning

Robo-advisors have gained popularity in the fintech space for their ability to provide automated, low-cost investment management services based on algorithms and data analysis. Some benefits of using robo-advisors include:

- Accessibility: Robo-advisors make investing accessible to individuals with lower capital, as they often have lower minimum investment requirements compared to traditional financial advisors.

- Diversification: Robo-advisors offer diversified investment portfolios based on individual risk tolerance and financial goals, helping to reduce risk and optimize returns.

- Cost-Effective: Robo-advisors typically have lower fees than traditional financial advisors, making them a cost-effective option for those looking to invest without high management fees.

Fintech Regulations and Compliance

In the world of financial technology (fintech), regulations and compliance play a crucial role in shaping how companies operate and interact with customers. Let’s dive into the regulatory landscape for fintech companies and explore the challenges they face in complying with regulations across different countries.

Regulatory Landscape for Fintech Companies

- Fintech companies are subject to a variety of regulations depending on the services they offer and the countries they operate in. These regulations can cover areas such as data protection, cybersecurity, anti-money laundering, and consumer protection.

- Regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the US oversee fintech companies and ensure they comply with relevant laws and guidelines.

- Navigating the complex regulatory landscape can be challenging for fintech startups, as they may lack the resources or expertise to fully understand and comply with all the regulations that apply to them.

Challenges of Complying with Regulations in Different Countries

- One of the major challenges for fintech companies is the need to comply with regulations in multiple countries if they operate internationally. Each country has its own set of rules and requirements, making compliance a complex and time-consuming process.

- Differences in regulatory frameworks across countries can also lead to inconsistencies in how fintech companies are allowed to operate, creating barriers to entry and hindering innovation in the industry.

- Fintech firms must invest in compliance tools and technologies to ensure they meet regulatory requirements in all the countries where they do business. This can be costly and resource-intensive, particularly for smaller companies.

Adapting to Changing Regulatory Environments

- Fintech firms are constantly evolving to adapt to changing regulatory environments and stay ahead of compliance requirements. This may involve hiring compliance experts, implementing robust compliance programs, and staying informed about new regulations as they are introduced.

- Some fintech companies are leveraging technology such as artificial intelligence and machine learning to automate compliance processes and improve efficiency. These tools can help companies monitor transactions, detect suspicious activity, and ensure compliance with regulations in real-time.

- Collaboration with regulatory bodies and industry stakeholders is also essential for fintech firms to stay compliant and address any regulatory challenges proactively. By working together, companies can help shape regulations that are fair, transparent, and conducive to innovation in the fintech sector.