Diving deep into the world of student loan interest rate calculation, this intro sets the stage for an intriguing exploration of the factors that determine how much you’ll pay back. From fixed vs. variable rates to federal vs. private loans, get ready to uncover the secrets behind the digits.

Get your calculators ready, because we’re about to break down the complexities of student loan interest rates in a way that’s easy to understand and totally rad.

Understanding Student Loan Interest Rates

When it comes to student loan interest rates, it’s essential to know how they are calculated and what factors influence them. Let’s dive into the details to gain a better understanding.

Types of Student Loan Interest Rate Calculations

- Fixed Interest Rate: This type of interest rate remains the same throughout the life of the loan. It provides predictability and stability for borrowers.

- Variable Interest Rate: With a variable interest rate, the rate can fluctuate based on market conditions. This can lead to changes in monthly payments over time.

- Compound Interest: Student loans often accrue compound interest, where interest is calculated on the initial principal balance as well as the accumulated interest. This can result in higher overall costs for borrowers.

Factors Influencing Student Loan Interest Rates

- Credit Score: A higher credit score generally leads to lower interest rates, as it signifies lower risk for lenders.

- Loan Term: Shorter loan terms typically come with lower interest rates, while longer terms may have higher rates to account for extended repayment periods.

- Market Conditions: Fluctuations in the economy and financial markets can impact interest rates, especially for variable rate loans.

- Type of Loan: Federal student loans generally have lower interest rates compared to private loans, due to government subsidies and borrower protections.

Fixed vs. Variable Interest Rates

When it comes to student loans, the interest rate can either be fixed or variable. Let’s break down the key differences between the two.

Fixed Interest Rates

Fixed interest rates for student loans remain the same throughout the life of the loan. This means that your monthly payment amount will not change, providing predictability and stability for budgeting purposes. The fixed interest rate is determined at the time you take out the loan and is based on various factors such as the current market rates, the type of loan, and your credit history.

- Fixed interest rates are calculated by adding a margin (a percentage determined by the lender) to a base rate, such as the 10-year Treasury note rate.

- For example, if the base rate is 3% and the lender’s margin is 2%, the fixed interest rate on your student loan would be 5%.

- It’s important to note that fixed interest rates may be slightly higher initially compared to variable rates, but they provide the security of knowing your interest payments will not increase over time.

Variable Interest Rates

Variable interest rates, on the other hand, can fluctuate over time based on changes in the market. This means that your monthly payments could vary, making it harder to predict how much you’ll owe each month. Variable interest rates are typically lower than fixed rates initially but can increase if market rates rise.

- Variable interest rates are usually tied to an index, such as the prime rate or the London Interbank Offered Rate (LIBOR), plus a margin set by the lender.

- For example, if the index rate is 4% and the lender’s margin is 3%, the variable interest rate on your loan would be 7%.

- It’s important to understand that while variable interest rates may start lower, they come with the risk of potentially increasing over time, leading to higher overall costs if market rates rise.

Impact of Interest Rates on Loan Repayment

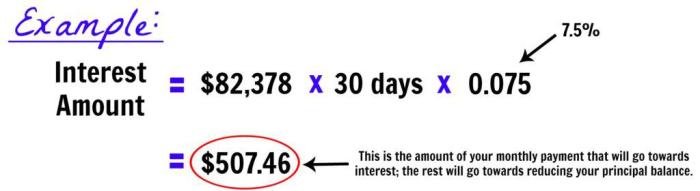

When it comes to student loans, the interest rate plays a crucial role in determining the overall cost of borrowing money for education. Understanding how different interest rates can affect your loan repayment is essential for managing your finances effectively.

Interest rates have a direct impact on the total amount repaid on a student loan. A higher interest rate means you will end up paying more over the life of the loan compared to a lower interest rate. This can significantly increase the financial burden on borrowers, especially if they have a large loan amount.

Effect on Total Amount Repaid

- For example, consider a $30,000 student loan with a 5% interest rate and a 10-year repayment term. The total amount repaid would be approximately $39,967.

- If the interest rate increases to 7%, the total amount repaid would jump to around $43,358 for the same loan amount and term.

- On the other hand, if the interest rate decreases to 3%, the total amount repaid would be lower at around $36,186.

Impact on Monthly Payments

- When interest rates rise, monthly loan payments also increase. This means borrowers have to allocate more of their income towards loan repayment, potentially affecting their overall financial health.

- Conversely, lower interest rates result in lower monthly payments, providing borrowers with more financial flexibility and potentially allowing them to save or invest the difference.

Strategies for Managing High-Interest Rates

- Consider refinancing your student loans to secure a lower interest rate, especially if you have a good credit score and financial stability.

- Make extra payments towards the principal balance to reduce the overall interest paid over time and shorten the repayment period.

- Explore income-driven repayment plans or loan forgiveness programs to alleviate the burden of high-interest rates, especially for federal student loans.

Federal vs. Private Student Loan Interest Rates

When it comes to student loans, understanding the difference between federal and private student loan interest rates is crucial. Let’s dive into the comparison and contrast between the two.

Interest Rate Setting for Federal Student Loans

Federal student loan interest rates are set by Congress and are fixed for the life of the loan. The rates are determined based on the yield of the 10-year Treasury note at the last auction before June 1st each year. This means that all borrowers with the same type of federal loan will have the same interest rate, regardless of their credit score or financial situation.

Variability of Interest Rates Among Private Lenders

Unlike federal student loans, private student loan interest rates can vary greatly among different lenders. Private lenders set their own interest rates based on several factors, including the borrower’s credit score, income, and co-signer (if applicable). This means that borrowers with excellent credit may be able to secure lower interest rates, while those with poor credit may face higher rates or may not even qualify for a private loan.