Get ready to dive into the world of retirement savings plans, where financial freedom meets smart investment choices. We’ll break down the different types of plans, the importance of early savings, and strategies to maximize your savings for a secure future. So grab your pens and calculators, it’s time to plan for retirement like a boss!

Let’s jump into the details of each retirement savings plan and explore how you can make the most out of your hard-earned money.

Types of Retirement Savings Plans

When it comes to planning for retirement, there are several types of retirement savings plans available to help individuals secure their financial future. Each type of plan has its own set of benefits and drawbacks, so it’s important to understand the differences between them.

401(k) Plan

A 401(k) plan is a type of employer-sponsored retirement plan that allows employees to contribute a portion of their pre-tax income towards retirement savings. One of the key benefits of a 401(k) plan is that many employers offer matching contributions, which can help boost your savings over time. However, one drawback is that there are contribution limits and early withdrawal penalties.

IRA (Individual Retirement Account)

An IRA is a retirement savings account that individuals can open on their own, separate from their employer. There are two main types of IRAs – traditional and Roth. With a traditional IRA, contributions are tax-deductible, but withdrawals in retirement are taxed. On the other hand, Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

Pension Plan

A pension plan is a retirement plan that is funded by an employer on behalf of its employees. With a pension plan, the employer is responsible for managing the investments and ensuring that retirees receive a set monthly income during retirement. One of the main benefits of a pension plan is the guaranteed income, but a drawback is that not all employers offer pension plans anymore.

Comparison and Contrast

– 401(k): Employer-sponsored, with matching contributions, contribution limits, and early withdrawal penalties.

– IRA: Individual retirement account, with traditional (tax-deductible contributions, taxable withdrawals) and Roth (after-tax contributions, tax-free withdrawals) options.

– Pension Plan: Employer-funded retirement plan, provides a guaranteed income during retirement.

Importance of Saving for Retirement

Saving for retirement is crucial for ensuring financial security in your later years. The earlier you start saving, the more time your money has to grow and accumulate over time. This can help you build a substantial nest egg to support yourself during retirement.

Impact of Inflation on Retirement Savings

Inflation can erode the purchasing power of your retirement savings over time. As the cost of living increases, the value of your savings decreases. This means that if you do not account for inflation when saving for retirement, you may not have enough money to cover your expenses in the future. It is important to consider inflation when planning for retirement and adjust your savings accordingly.

Compound Interest and Retirement Savings

Compound interest is a powerful tool that can help your retirement savings grow exponentially over time. By earning interest on both your initial investment and the interest that has already been added to your account, you can accelerate the growth of your savings. The longer your money is invested, the more it can benefit from the effects of compound interest. Starting to save early and allowing your money to compound over time can make a significant difference in the size of your retirement fund.

Employer-Sponsored Retirement Plans

When it comes to saving for retirement, employer-sponsored retirement plans play a crucial role in helping individuals build their nest egg for the future. These plans are offered by companies as a benefit to their employees, allowing them to save and invest for retirement with ease.

Defined Benefit Plans vs. Defined Contribution Plans

Defined Benefit Plans:

– In a defined benefit plan, the employer guarantees a specific benefit amount to employees upon retirement.

– The benefit is usually based on factors such as salary history and years of service.

– Employees do not have control over the investment decisions as the employer manages the plan’s investments.

Defined Contribution Plans:

– In a defined contribution plan, employees contribute a portion of their salary to their retirement account.

– The employer may also contribute to the plan, often matching a percentage of the employee’s contributions.

– Employees have control over how the funds are invested, typically choosing from a selection of investment options.

Maximizing Employer Contributions

To maximize employer contributions to retirement savings plans, consider the following tips:

– Contribute enough to take full advantage of employer matching contributions, as this is essentially free money.

– Take advantage of any additional employer contributions, such as profit-sharing contributions.

– Consider increasing your own contributions to reach the maximum allowable limit, maximizing your retirement savings potential.

Individual Retirement Accounts (IRAs)

When it comes to saving for retirement, Individual Retirement Accounts (IRAs) are a popular choice for many Americans. These accounts offer tax advantages and can help individuals build a nest egg for their golden years.

Eligibility Requirements for Traditional and Roth IRAs

To be eligible for a traditional IRA, you must be under the age of 70 ½ and have earned income. On the other hand, Roth IRAs have income limits that determine eligibility. For 2021, the income limit for single filers is $140,000 and for married couples filing jointly, it is $208,000.

Tax Advantages of Traditional IRAs vs. Roth IRAs

– Traditional IRAs: Contributions to a traditional IRA are tax-deductible, which means you can reduce your taxable income for the year in which you make the contribution. However, withdrawals in retirement are taxed as ordinary income.

– Roth IRAs: Contributions to a Roth IRA are made with after-tax dollars, so you don’t get an immediate tax deduction. However, qualified withdrawals in retirement are tax-free.

Choosing Between Traditional and Roth IRAs

When deciding between a traditional and Roth IRA, it’s important to consider your current tax situation and your future financial goals. Here are some strategies to help you choose:

– If you expect to be in a lower tax bracket in retirement, a traditional IRA may be more beneficial due to the upfront tax deduction.

– On the other hand, if you anticipate being in a higher tax bracket during retirement or if you want tax-free withdrawals, a Roth IRA could be the better option.

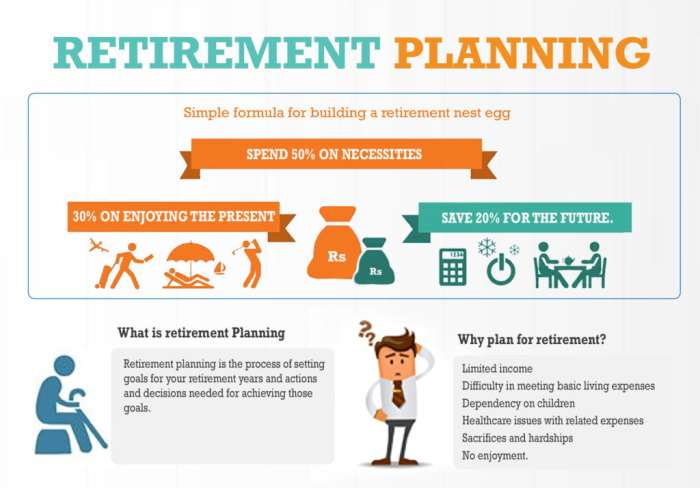

Planning for Retirement

Planning for retirement is a crucial step in ensuring financial security in your later years. It involves setting goals, developing a savings plan, and making adjustments as needed.

Steps to Develop a Retirement Savings Plan

- Assess your current financial situation, including income, expenses, and existing savings.

- Estimate your retirement expenses, considering factors like healthcare, housing, and leisure activities.

- Set savings goals based on your desired retirement lifestyle and timeline.

- Choose appropriate retirement savings vehicles, such as 401(k) plans or IRAs.

- Monitor your progress regularly and make adjustments as needed.

Importance of Setting Retirement Savings Goals

Setting retirement savings goals gives you a clear target to work towards and helps you stay motivated to save consistently. It allows you to track your progress and make informed decisions about your finances.

Tips for Adjusting Retirement Savings Plans

- Reassess your savings goals periodically to account for changing life circumstances or financial priorities.

- Consider increasing your contributions if you receive a raise or bonus to accelerate your savings.

- Explore investment options that align with your risk tolerance and retirement timeline.

- Consult with a financial advisor for personalized advice on optimizing your retirement savings strategy.