Get ready to dive into the world of Real estate investment strategies. From long-term to short-term approaches, financing options, risk management, and market analysis, this guide covers it all in a way that’s easy to understand and implement.

Overview of Real Estate Investment Strategies

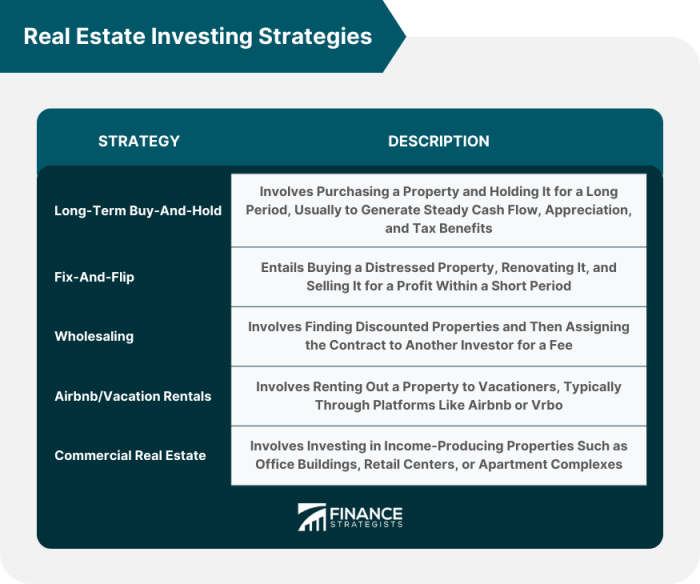

Real estate investment strategies are specific plans or methods that investors use to maximize their returns on real estate properties. These strategies help investors identify opportunities, mitigate risks, and achieve their financial goals.

Types of Real Estate Investment Strategies

- Buy and Hold: Investors purchase properties with the intention of holding onto them for an extended period, generating rental income, and potentially selling at a profit in the future.

- Fix and Flip: Investors buy properties that need repairs or renovations, improve them, and sell them quickly for a higher price to make a profit.

- Wholesaling: Investors act as intermediaries, securing properties at a discounted price and selling them to other investors for a fee without taking ownership.

- Rental Arbitrage: Investors rent out properties on short-term rental platforms like Airbnb to generate passive income that exceeds the monthly expenses.

Importance of Having a Strategy in Real Estate Investment

Having a solid real estate investment strategy is crucial for success in the market. It helps investors stay focused, make informed decisions, and achieve their financial objectives. Without a clear strategy, investors may end up making costly mistakes or missing out on profitable opportunities.

Long-Term vs. Short-Term Investment Strategies

When it comes to real estate investment strategies, investors often have to decide between long-term and short-term approaches. Each strategy has its own set of advantages and disadvantages, depending on the investor’s goals and risk tolerance.

Long-Term Investment Strategy

Long-term real estate investment strategies involve purchasing properties with the intention of holding onto them for an extended period, typically five years or more. This approach focuses on building equity over time and generating passive income through rental payments.

- Advantages:

- Steady cash flow from rental income

- Potential for property appreciation over time

- Tax benefits such as depreciation deductions

- Disadvantages:

- Lack of liquidity, as the investment is tied up in the property

- Longer time horizon for potential returns

- Market fluctuations can impact property values

Examples of properties suitable for long-term investment strategies include multi-family homes, commercial buildings, and rental properties in stable markets with high demand for rentals.

Short-Term Investment Strategy

Short-term real estate investment strategies involve purchasing properties with the intention of selling them quickly for a profit. This approach is often referred to as “flipping” properties and requires investors to identify undervalued properties that can be renovated or improved for a quick turnaround.

- Advantages:

- Potential for quick profits through property appreciation

- Lower holding costs compared to long-term investments

- Ability to leverage market trends for quick sales

- Disadvantages:

- Higher risk due to market volatility

- Requires active involvement in property management and renovations

- Tax implications for short-term capital gains

Examples of properties suitable for short-term investment strategies include distressed properties, fixer-uppers, and properties in up-and-coming neighborhoods with potential for rapid appreciation.

Financing Options for Real Estate Investment

Investing in real estate often requires financing to make the purchase. There are various financing options available to investors, each with its own advantages and considerations. Let’s explore some of the common financing options for real estate investments.

Traditional Bank Loans

Traditional bank loans are one of the most common ways to finance real estate investments. These loans typically offer lower interest rates and longer repayment terms compared to alternative financing methods. However, they often require a high credit score and a substantial down payment.

Hard Money Loans

Hard money loans are another financing option for real estate investors, especially for those with less-than-perfect credit or who need quick access to funding. These loans are typically provided by private investors or companies and have higher interest rates and shorter terms than traditional bank loans.

Crowdfunding

Crowdfunding has emerged as a popular alternative financing method for real estate investments. Through online platforms, investors can pool their funds to finance a real estate project. This option allows for smaller investments and diversification across multiple properties.

Choosing the right financing option can significantly impact an investment strategy. For example, traditional bank loans may be more suitable for long-term investments where the investor can benefit from lower interest rates over time. On the other hand, hard money loans may be a better fit for short-term investments that require quick access to capital.

Risk Management in Real Estate Investment

Real estate investment can be lucrative, but it also comes with its fair share of risks. It’s crucial for investors to have a solid risk management strategy in place to protect their investments and minimize potential losses.

Diversification

Diversification is a key strategy in managing risk in real estate investment. By spreading investments across different types of properties, locations, and markets, investors can reduce their exposure to any single risk factor. This helps to mitigate the impact of market fluctuations and economic downturns.

- Diversify across property types (residential, commercial, industrial)

- Invest in different geographic locations

- Consider investing in both developed and emerging markets

Hedging Against Market Fluctuations

Hedging is another effective risk management strategy in real estate investment. Investors can use various financial instruments to protect their investments from adverse market movements. For example, they can enter into derivatives contracts or use options to hedge against potential losses.

“Hedging allows investors to limit their downside risk while still maintaining exposure to potential upside gains.”

Role of Insurance

Insurance plays a crucial role in mitigating risks in real estate investments. Investors can protect their properties against damage, liability, and other unforeseen events by having the right insurance coverage in place. This provides a safety net in case of emergencies and helps to safeguard their investment portfolio.

“Having comprehensive insurance coverage can provide peace of mind and financial protection for real estate investors.”

Market Analysis for Successful Investment Strategies

Before diving into real estate investments, it is crucial to conduct a thorough market analysis to ensure success in your investment strategy. By understanding the market conditions and trends, investors can make informed decisions that maximize their returns and mitigate risks.

Key Factors to Consider in Analyzing Real Estate Markets

- Economic indicators such as job growth, GDP, and interest rates can provide insight into the overall health of the real estate market.

- Demographic trends, such as population growth, age distribution, and household income, can help identify target markets for investment.

- Supply and demand dynamics play a significant role in determining property values and rental rates in specific areas.

- Market trends, including inventory levels, days on market, and pricing trends, can indicate opportunities for investment or potential risks.

How Market Analysis Influences Decision-Making in Real Estate Investments

- Market analysis helps investors identify emerging markets with growth potential and avoid areas that may be oversaturated or declining.

- Understanding market dynamics allows investors to set realistic investment goals and strategies that align with market conditions.

- By analyzing market data, investors can make informed decisions on property selection, pricing, and timing of investments to optimize returns.

- Market analysis also enables investors to adapt their investment strategies based on changing market conditions to stay competitive and profitable.