Kicking off with mutual funds vs ETFs, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

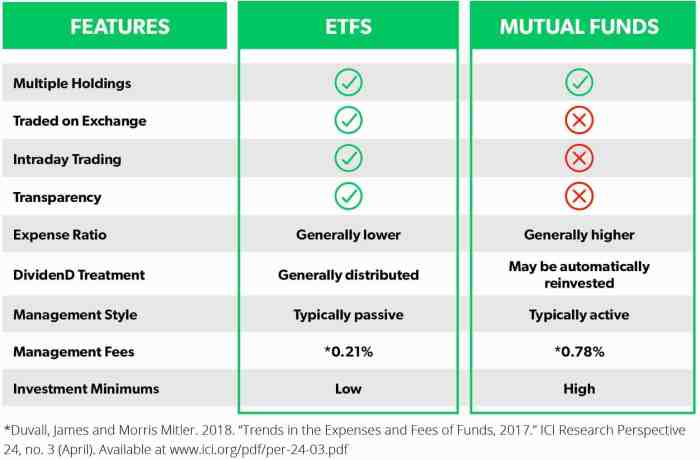

When it comes to investing, mutual funds and ETFs are two heavyweight contenders that often go head-to-head. Let’s dive into the world of these investment options and see how they stack up against each other.

Introduction to Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) are popular investment options that allow individuals to pool their money together to invest in a diversified portfolio of stocks, bonds, or other securities.

Mutual Funds

Mutual funds are investment vehicles that are managed by professional fund managers. Investors buy shares of the mutual fund, which in turn invests in a diversified portfolio of assets. Mutual funds are typically actively managed, meaning that fund managers make decisions on which securities to buy and sell in an attempt to outperform the market.

- Mutual funds are priced once a day after the market closes.

- Investors can buy or sell mutual fund shares directly from the fund company.

- Popular mutual funds include Vanguard Total Stock Market Index Fund and Fidelity Magellan Fund.

ETFs

ETFs are similar to mutual funds in that they also offer investors a way to invest in a diversified portfolio of assets. However, ETFs are traded on stock exchanges like individual stocks.

- ETFs can be bought and sold throughout the trading day at market prices.

- ETFs typically have lower expense ratios compared to mutual funds.

- Examples of popular ETFs include SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust (QQQ).

Structure and Management

When it comes to the structure and management of mutual funds and ETFs, there are some key differences that investors should be aware of.

Mutual Funds

Mutual funds are pooled investment vehicles that are actively managed by professional portfolio managers. These managers make decisions on buying and selling securities within the fund to achieve the fund’s investment objectives. Mutual funds typically have a board of directors or trustees that oversee the fund’s operations and ensure compliance with regulations. Investors can buy or sell mutual fund shares at the end of the trading day based on the net asset value (NAV) of the fund.

ETFs

ETFs, or exchange-traded funds, are also pooled investment vehicles, but they are structured differently from mutual funds. ETFs are passively managed and aim to track the performance of a specific index or asset class. This means that ETF managers do not actively buy and sell securities within the fund but instead replicate the holdings of the underlying index. ETFs are traded on exchanges throughout the day like individual stocks, and their prices fluctuate based on supply and demand.

Comparison of Management Styles

The main difference in management styles between mutual funds and ETFs lies in their approach to portfolio management. Mutual funds have active management, where professional managers make investment decisions to outperform the market. On the other hand, ETFs have passive management, where they aim to replicate the performance of an index without trying to beat it. This difference can impact the fees associated with each type of investment, as actively managed mutual funds tend to have higher expense ratios compared to passively managed ETFs.

Cost Differences

When it comes to investing in mutual funds, there are various fees that investors need to be aware of. These fees typically include sales loads, management fees, and 12b-1 fees. Sales loads are charges that investors pay either when buying or selling shares of a mutual fund. Management fees are ongoing expenses that cover the costs of managing the fund’s portfolio. Lastly, 12b-1 fees are used for marketing and distribution expenses. All these fees can add up and impact the overall return on investment for mutual fund investors.

On the other hand, investing in ETFs usually involves lower costs compared to mutual funds. ETFs generally have lower expense ratios, which are the annual fees charged by the fund to cover operating expenses. These expenses are typically lower because ETFs are passively managed and do not require as much active management as mutual funds. Additionally, ETFs do not have sales loads and tend to have lower turnover rates, resulting in lower transaction costs.

Expense Ratios Comparison

Expense ratios are an important factor to consider when comparing mutual funds and ETFs. The expense ratio is the annual fee charged by the fund as a percentage of the total assets under management. In general, ETFs have lower expense ratios compared to mutual funds. This is due to the passive management style of most ETFs, which leads to lower operating costs. On the other hand, mutual funds often have higher expense ratios because of the active management involved.

Overall, when it comes to cost differences between mutual funds and ETFs, ETFs tend to be more cost-effective for investors due to their lower fees and expense ratios. This can ultimately lead to higher returns for investors over the long term.

Liquidity and Trading

When it comes to investing in mutual funds and ETFs, understanding liquidity and trading is crucial for investors to make informed decisions about their portfolios.

Liquidity of Mutual Funds

Mutual funds are typically less liquid compared to ETFs. This is because mutual funds are only traded at the end of the trading day at the net asset value (NAV) price. Investors looking to buy or sell mutual fund shares will receive the price calculated at the end of the day, regardless of when they place their order.

ETFs Offering Liquidity

ETFs, on the other hand, offer greater liquidity to investors. ETFs trade on stock exchanges throughout the day at market prices. This means investors can buy or sell ETF shares at any point during market hours, providing more flexibility compared to mutual funds.

Trading Process Comparison

– Mutual Funds:

- Traded at NAV price at the end of the trading day.

- Orders placed throughout the day are executed at the closing price.

- Less flexibility for investors to react to market changes intraday.

– ETFs:

- Traded on stock exchanges throughout the day at market prices.

- Investors can buy or sell ETF shares at any point during market hours.

- Provides more flexibility for investors to react to market changes intraday.

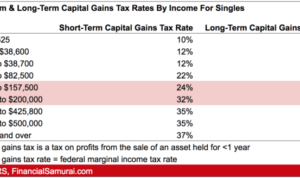

Tax Efficiency

When it comes to tax efficiency, both mutual funds and ETFs have different implications that investors need to consider. Let’s dive into the specifics of each investment type.

Tax Implications of Investing in Mutual Funds

- Mutual funds are known for their tax inefficiency due to the structure of the fund. When the fund manager buys or sells securities within the fund, it can trigger capital gains taxes for investors.

- Investors in mutual funds may also be subject to capital gains distributions, even if they did not sell any shares themselves. This can lead to unexpected tax liabilities for investors.

Tax Advantages of ETFs Compared to Mutual Funds

- ETFs are generally more tax-efficient compared to mutual funds. This is because of the unique structure of ETFs, which allows for in-kind transactions and redemption, reducing the need to sell securities and trigger capital gains.

- ETF investors have more control over when they realize capital gains since they can choose when to buy or sell shares on the open market. This can lead to lower tax liabilities for investors.

Examples of Tax Efficiency Differences

- For example, if an investor holds a mutual fund and the fund manager sells securities within the fund at a profit, all investors in the fund may be subject to capital gains taxes, even if they did not personally realize any gains.

- In contrast, an ETF investor can buy and sell shares on the open market without triggering capital gains for other investors in the ETF. This can provide greater tax efficiency and control for individual investors.