Managing credit card debt is like navigating the intricate hallways of high school, but with a twist – your financial future hangs in the balance. Get ready to dive into the world of credit card debt management with a cool and savvy approach that will leave you feeling empowered and in control of your money matters.

In this guide, we’ll explore the ins and outs of credit card debt, from understanding its impact to exploring effective strategies for managing it like a pro.

Understanding Credit Card Debt

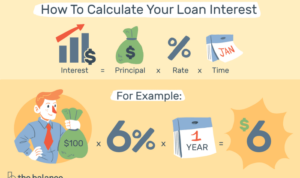

Credit card debt refers to the amount of money that a person owes to their credit card issuer. This debt accumulates when individuals use their credit cards to make purchases or cover expenses without paying off the full balance each month. The remaining balance is subject to interest charges, which can quickly add up if left unpaid.

Impact of High Credit Card Debt

High credit card debt can have a significant negative impact on an individual’s financial health. It can lead to a cycle of debt where the individual struggles to make minimum payments, resulting in increased interest charges and a growing balance. This can ultimately damage credit scores, making it harder to obtain loans or secure favorable interest rates in the future.

- Difficulty in achieving financial goals: People with high credit card debt may find it challenging to save money for emergencies, retirement, or other financial goals due to the burden of debt payments.

- Stress and anxiety: Constantly worrying about debt and financial obligations can take a toll on an individual’s mental health, leading to increased stress and anxiety.

- Limited financial freedom: High credit card debt can restrict a person’s ability to make important financial decisions, such as buying a home or starting a business, as lenders may view them as high-risk borrowers.

Common Reasons for Accruing Credit Card Debt

- Emergency expenses: Unexpected medical bills, car repairs, or other emergencies can force individuals to rely on credit cards to cover the costs.

- Lack of budgeting: Failing to create and stick to a budget can result in overspending and reliance on credit cards to make ends meet.

- Job loss or income reduction: Sudden loss of employment or a decrease in income can lead to financial strain, prompting individuals to use credit cards to maintain their standard of living.

Managing Credit Card Debt

When it comes to managing credit card debt, it’s crucial to have a solid plan in place to avoid falling into a financial trap. Making timely payments and steering clear of high interest rates are key to keeping your debt under control. Additionally, creating a budget tailored to paying off your credit card debt efficiently can help you stay on track and achieve your financial goals.

Strategies for Managing Credit Card Debt

- Make a list of all your credit card debts, including balances and interest rates, to prioritize which ones to pay off first.

- Consider transferring high-interest balances to a card with a lower interest rate or a balance transfer card with a promotional 0% APR offer.

- Avoid using your credit cards for unnecessary purchases while you focus on paying off your existing debt.

- Explore debt consolidation options such as a personal loan to consolidate multiple debts into one monthly payment with a lower interest rate.

Importance of Timely Payments and Avoiding High Interest Rates

- Timely payments help you avoid late fees and maintain a good credit score, which is crucial for future financial endeavors.

- Avoiding high interest rates can save you money in the long run and prevent your debt from spiraling out of control.

- Setting up automatic payments or reminders can help you stay on top of your credit card bills and prevent unnecessary charges.

Tips for Creating a Budget to Pay Off Credit Card Debt Efficiently

- Track your monthly income and expenses to understand where your money is going and identify areas where you can cut back.

- Allocate a specific amount towards paying off your credit card debt each month and stick to it to make steady progress.

- Consider using budgeting apps or spreadsheets to help you visualize your financial goals and track your progress over time.

- Adjust your budget as needed to accommodate unexpected expenses or changes in your financial situation to ensure you stay on track towards becoming debt-free.

Debt Consolidation Options

Debt consolidation is a strategy where you combine multiple debts into a single monthly payment, typically with a lower interest rate. This can make it easier to manage your debts and potentially save money in the long run.

Balance Transfers

- Transferring high-interest credit card debt to a new card with a lower interest rate.

- Pros: Potential for lower interest rates, simplified payments.

- Cons: Balance transfer fees, introductory rates that may increase after a certain period.

Personal Loans

- Borrowing a fixed amount from a lender to pay off credit card debt.

- Pros: Fixed interest rates, predictable monthly payments.

- Cons: May require good credit for approval, potential for higher interest rates.

Debt Management Plans

- Working with a credit counseling agency to create a repayment plan.

- Pros: Lower interest rates negotiated with creditors, guidance and support throughout the process.

- Cons: Lengthy repayment period, possible impact on credit score.

Credit Score Impact

When it comes to credit card debt, it’s important to understand how it can impact your credit score. Your credit score is a numerical representation of your creditworthiness, and it plays a crucial role in your financial life.

Carrying high credit card debt can have long-term consequences on your credit score and overall creditworthiness. When you have a high debt-to-credit ratio, it can signal to lenders that you may be overextended and have difficulty managing your finances. This can result in a lower credit score, making it harder to qualify for loans, credit cards, or favorable interest rates in the future.

To improve your credit score while managing credit card debt, consider the following tips:

1. Pay On Time, Every Time

One of the most important factors in determining your credit score is your payment history. Make sure to pay at least the minimum amount due on time every month to avoid late payments and negative marks on your credit report.

2. Keep Your Credit Utilization Low

Your credit utilization ratio, which is the amount of credit you’re using compared to the total amount available to you, also plays a significant role in your credit score. Aim to keep this ratio below 30% to show that you’re using credit responsibly.

3. Avoid Opening Too Many New Accounts

Opening multiple new credit accounts in a short period of time can negatively impact your credit score. It’s important to manage your credit responsibly and only apply for new credit when necessary.

4. Regularly Check Your Credit Report

Monitoring your credit report regularly can help you catch any errors or fraudulent activity that could be impacting your credit score. By staying informed, you can take steps to address any issues and improve your creditworthiness.