Dive into the world of low-interest personal loans where financial possibilities await. From understanding the basics to exploring different types and managing repayments, this guide has got you covered.

Get ready to discover the key factors and tips that can help you secure a low-interest personal loan tailored to your needs.

What are Low-Interest Personal Loans?

Low-interest personal loans are financial products offered by banks, credit unions, or online lenders with interest rates lower than the average market rate. These loans are typically used for various personal expenses such as home renovations, debt consolidation, or unexpected medical bills.

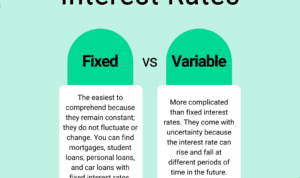

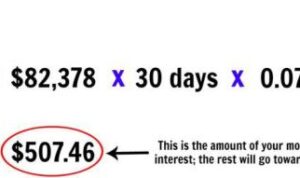

Interest rates on personal loans are determined based on several factors including the borrower’s credit score, income level, loan amount, and loan term. Borrowers with higher credit scores and stable incomes are likely to qualify for lower interest rates compared to those with poor credit histories.

Benefits of Low-Interest Personal Loans

- Save Money: By opting for a low-interest personal loan, borrowers can save a significant amount of money on interest payments over the life of the loan.

- Lower Monthly Payments: With lower interest rates, borrowers can enjoy more manageable monthly payments, making it easier to budget and repay the loan on time.

- Flexible Use: Unlike specific-purpose loans like auto loans or mortgages, low-interest personal loans can be used for a variety of personal expenses, giving borrowers the flexibility they need.

- Build Credit: Making timely payments on a low-interest personal loan can help improve the borrower’s credit score over time, opening up access to better financial opportunities in the future.

Types of Low-Interest Personal Loans

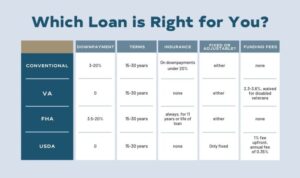

When it comes to low-interest personal loans, there are different types available to suit various financial needs. Let’s take a look at some common options:

Secured Personal Loans

Secured personal loans require collateral, such as a car or a house, to back the loan. This lowers the risk for the lender, resulting in lower interest rates. However, if the borrower fails to repay the loan, the lender can seize the collateral.

Unsecured Personal Loans

Unsecured personal loans do not require any collateral, making them a popular choice for borrowers who do not want to risk losing their assets. Since there is no collateral involved, interest rates on unsecured personal loans are typically higher compared to secured loans.

Eligibility Criteria

– For secured personal loans, borrowers need to have valuable collateral to offer to the lender.

– Unsecured personal loans usually require a good credit score to qualify, as it demonstrates the borrower’s ability to repay the loan.

– Both types of loans may also consider factors such as income, employment status, and debt-to-income ratio when determining eligibility.

Factors to Consider When Applying for Low-Interest Personal Loans

When considering applying for low-interest personal loans, there are several important factors to keep in mind to ensure you make the best decision for your financial situation.

Credit Scores and Interest Rates

Your credit score plays a crucial role in determining the interest rate you will receive on a personal loan. Lenders use your credit score to assess your creditworthiness and ability to repay the loan. A higher credit score typically results in a lower interest rate, while a lower credit score may lead to a higher interest rate. It’s essential to check your credit score before applying for a loan and work on improving it if needed.

- Higher credit scores can help you qualify for lower interest rates.

- Lower credit scores may result in higher interest rates on personal loans.

- Regularly monitor your credit report for any errors or discrepancies that could be affecting your score.

Tips for Improving Credit Scores

Improving your credit score can help you qualify for lower interest rates on personal loans, saving you money in the long run. Here are some tips to boost your credit score:

- Make all your payments on time to show lenders you are responsible.

- Keep your credit card balances low and pay off debt to lower your credit utilization ratio.

- Avoid opening multiple new credit accounts at once, as this can lower your average account age.

- Regularly check your credit report for errors and dispute any inaccuracies you find.

Where to Find Low-Interest Personal Loans

When looking for low-interest personal loans, it’s essential to consider reputable financial institutions that offer competitive rates. Here are some options to explore:

Reputable Financial Institutions Offering Low-Interest Personal Loans

- 1. Wells Fargo: Known for its diverse range of financial products, Wells Fargo provides low-interest personal loans with flexible terms.

- 2. LightStream: A division of SunTrust Bank, LightStream offers low rates for borrowers with good credit history.

- 3. SoFi: SoFi is a popular online lender that provides low-interest personal loans, especially for borrowers looking to consolidate debt.

Applying for a Low-Interest Personal Loan Online

When applying for a low-interest personal loan online, the process is usually straightforward and convenient. Here’s a general overview:

- Choose a reputable lender: Research and select a lender that offers competitive rates and terms.

- Complete the online application: Provide necessary personal and financial information required by the lender.

- Submit documentation: Upload any required documents, such as proof of income or identification.

- Review and accept the loan offer: Once approved, carefully review the loan terms and accept the offer if it meets your needs.

- Receive funds: After accepting the offer, the funds will typically be deposited into your account within a few business days.

Importance of Comparing Offers from Multiple Lenders

It’s crucial to compare offers from multiple lenders when seeking a low-interest personal loan to ensure you get the best deal possible. Here’s why:

By comparing offers, you can find the lowest interest rate and most favorable terms that suit your financial situation.

Additionally, comparing offers allows you to assess different fees, repayment options, and customer service quality, helping you make an informed decision.

Managing Low-Interest Personal Loans

When it comes to managing low-interest personal loans, it’s essential to have a solid plan in place to ensure you stay on top of your repayments and avoid any financial pitfalls. Here are some strategies to help you effectively manage your low-interest personal loan:

Set Up a Budget

- Create a detailed budget outlining your income and expenses.

- Allocate a specific amount each month towards your loan repayment.

- Avoid unnecessary expenses to free up more funds for loan repayment.

Avoid Missing Payments

- Set up automatic payments to ensure you never miss a due date.

- Keep track of your payment schedule and plan ahead for any financial fluctuations.

- Contact your lender immediately if you foresee any issues with making a payment.

Consequences of Defaulting

- Defaulting on a low-interest personal loan can severely impact your credit score.

- You may face legal action or debt collection efforts from the lender.

- Defaulting can lead to additional fees, penalties, and higher interest rates.

Pay Off Early

- Consider making extra payments whenever possible to reduce the total interest paid.

- Use windfalls such as tax refunds or bonuses to make lump sum payments towards the loan.

- Refinance the loan if you can secure a better interest rate to pay it off sooner.