Dive into the world of loan interest rate calculation where numbers dance and formulas weave a complex tapestry of financial intricacies. From understanding the different methods to exploring the impact of compound interest, this topic promises to unravel the mysteries behind loan interest rates.

Get ready to embark on a journey that will equip you with the knowledge to navigate the realm of loan interest rate calculation with confidence and clarity.

Loan Interest Rate Calculation Methods

When it comes to calculating loan interest rates, there are several methods used by financial institutions to determine how much interest a borrower will pay over the life of the loan. Understanding these methods is crucial for borrowers to make informed decisions when taking out a loan.

Simple Interest Calculation

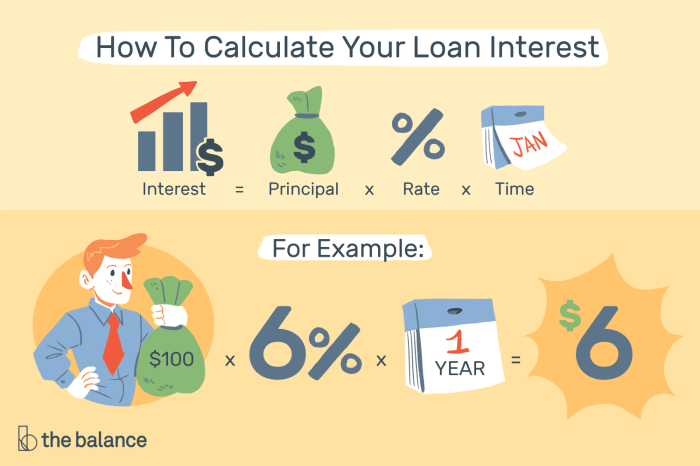

Simple interest is calculated based on the principal amount of the loan and the interest rate. The formula for simple interest is:

Simple Interest = Principal x Rate x Time

For example, if you borrow $1,000 at an interest rate of 5% for one year, the simple interest would be $50 ($1,000 x 0.05 x 1).

Compound Interest Calculation

Compound interest takes into account the interest that accrues on both the principal amount and any previously accumulated interest. The formula for compound interest is:

Compound Interest = Principal x (1 + Rate)^Time – Principal

For instance, if you borrow $1,000 at an interest rate of 5% compounded annually for two years, the compound interest would be $102.50.

Factors Influencing Interest Rates

Several factors influence the calculation of loan interest rates, including:

- The borrower’s credit score and financial history

- The current market interest rates

- The type and term of the loan

- Economic conditions and inflation rates

Understanding these factors can help borrowers negotiate better interest rates and terms when applying for a loan.

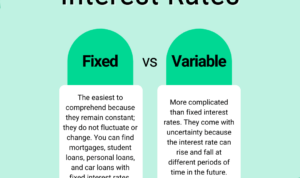

Simple Interest vs. Compound Interest

When it comes to calculating loan interest rates, it’s important to understand the difference between simple interest and compound interest. Simple interest is calculated only on the principal amount borrowed, while compound interest takes into account both the principal and the accumulated interest.

Simple Interest Calculation

Simple interest is calculated using the formula:

Simple Interest = Principal x Rate x Time

- For example, if you borrow $1000 at an interest rate of 5% for 2 years, the simple interest would be:

Simple Interest = $1000 x 0.05 x 2 = $100

- This means you would pay back a total of $1100 ($1000 principal + $100 interest).

Compound Interest Impact

Compound interest can significantly increase the total amount repaid over time compared to simple interest. This is because with compound interest, the interest is added to the principal amount, and future interest is calculated on the new total.

- For instance, if you borrow $1000 at an interest rate of 5% compounded annually for 2 years, the total amount repaid would be:

Total Amount = $1000 x (1 + 0.05)^2 = $1102.50

- As you can see, the total amount repaid with compound interest is higher than with simple interest due to the compounding effect.

Factors Affecting Loan Interest Rates

When it comes to loan interest rates, several factors come into play that can significantly impact the final rate you end up paying. Understanding these key factors is crucial for anyone looking to take out a loan and manage their finances wisely.

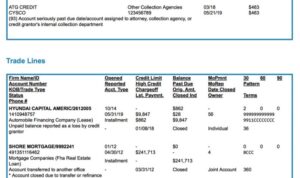

Credit Score and Loan Term Length

Your credit score plays a major role in determining the interest rate you are offered on a loan. Lenders use your credit score to assess your creditworthiness and ability to repay the loan. A higher credit score typically results in a lower interest rate, as it demonstrates a lower risk for the lender.

Additionally, the length of the loan term can also affect the interest rate. Shorter loan terms usually come with lower interest rates, while longer loan terms may have higher rates. This is because longer loan terms carry more risk for the lender, as there is a longer period of time for potential changes in your financial situation.

Inflation and Market Conditions

Inflation and overall market conditions can have a significant impact on loan interest rates. Inflation refers to the increase in prices of goods and services over time, which can erode the purchasing power of your money. When inflation is high, lenders may increase interest rates to compensate for the decrease in the value of money over time.

Market conditions, such as the state of the economy, interest rate trends, and the demand for loans, also play a role in determining interest rates. During times of economic uncertainty or recession, interest rates may be lower to stimulate borrowing and spending. Conversely, during periods of economic growth, interest rates may rise to curb inflation and control economic activity.

Overall, understanding these factors that affect loan interest rates can help you make informed decisions when taking out a loan and managing your financial obligations effectively.

Amortization Schedules and Interest Payments

An amortization schedule is a table that Artikels the repayment of a loan over time, showing each payment’s breakdown between principal and interest. It is a crucial tool for borrowers to understand how their payments are structured and how much interest they will pay over the life of the loan.

Calculating Interest Payments in an Amortization Schedule

An amortization schedule typically begins with a fixed monthly payment that is divided between interest and principal. The interest component is calculated based on the remaining balance of the loan and the interest rate. Here’s a step-by-step guide on how interest payments are calculated within an amortization schedule:

- The interest for each period is calculated by multiplying the remaining loan balance by the monthly interest rate.

- The principal portion of the payment is the total payment minus the interest amount.

- The remaining loan balance is reduced by the principal portion of the payment, and the process repeats for each period until the loan is fully repaid.

Interest Payment = Remaining Loan Balance * Monthly Interest Rate

Impact of Early or Additional Payments

Making early or additional payments towards the principal can significantly reduce the total interest paid over the life of the loan. By reducing the principal balance, borrowers can shorten the repayment term and save on interest costs. Even small additional payments can make a big difference in the long run, helping borrowers pay off their loans faster and with less interest.