Let’s dive into the world of financial goals and why they are crucial for your financial success. From setting clear objectives to achieving them, we’ll explore how financial goals can impact your overall financial well-being. Get ready to level up your money game!

Importance of Setting Financial Goals

Setting financial goals is crucial for financial success because it provides a clear roadmap for achieving your desired financial outcomes. Without goals, it’s easy to lose track of where you want to be financially and end up making impulsive decisions that may not align with your long-term objectives.

Financial goals can provide direction and motivation for personal finances by giving you something specific to work towards. Whether it’s saving for a down payment on a house, paying off student loans, or building an emergency fund, having clear goals can help you stay focused and disciplined in your financial decisions.

The impact of clear financial goals on budgeting and saving habits is significant. When you have a specific goal in mind, you are more likely to create a budget that aligns with your objectives and prioritize saving money to reach your targets. This can lead to better financial habits overall, as you are more mindful of how you are spending and saving your money to achieve your goals.

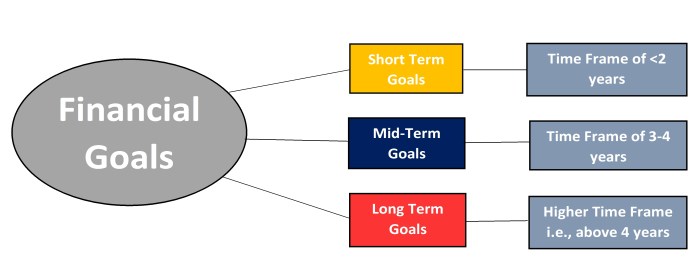

Types of Financial Goals

Financial goals can be categorized into three main types: short-term, medium-term, and long-term. Each type of financial goal has its own set of characteristics and serves a specific purpose in helping individuals achieve financial stability and success.

Short-term Financial Goals

Short-term financial goals are typically achievable within one year or less. These goals are focused on immediate needs and priorities, such as building an emergency fund, paying off credit card debt, or saving for a vacation. Short-term goals are important for establishing good financial habits and gaining momentum towards larger financial objectives.

- Creating an emergency fund with three to six months’ worth of living expenses.

- Paying off high-interest credit card debt to avoid accumulating interest charges.

- Saving for a specific short-term purchase like a new laptop or a weekend getaway.

Medium-term Financial Goals

Medium-term financial goals typically have a timeline of one to five years. These goals are more substantial than short-term goals but do not require the long-term commitment of larger financial objectives. Examples of medium-term financial goals include saving for a down payment on a house, purchasing a car, or funding a child’s education.

- Saving for a down payment on a home to achieve homeownership.

- Investing in a retirement account to secure financial stability in the future.

- Paying for a child’s college tuition to support their education and future opportunities.

Long-term Financial Goals

Long-term financial goals are those that require a commitment of five years or more to achieve. These goals often involve major life milestones or aspirations, such as retirement planning, building wealth, or leaving a financial legacy for future generations.

- Building a retirement nest egg to maintain a comfortable lifestyle in retirement.

- Investing in a diversified portfolio to grow wealth over time.

- Establishing a trust fund or charitable foundation to leave a lasting impact on society.

Benefits of Achieving Financial Goals

Reaching financial goals comes with a multitude of benefits that can positively impact your life in various ways.

Financial Security

One of the key advantages of achieving financial goals is the sense of security it brings. By reaching your financial milestones, you are better equipped to handle unexpected expenses, emergencies, and financial downturns. This stability can provide peace of mind and a safety net for you and your loved ones.

Reduced Stress and Improved Well-being

Successfully meeting your financial goals can significantly reduce stress levels. As you gain control over your finances and work towards your objectives, you can experience a sense of relief and reduced anxiety about money matters. This can lead to improved overall well-being and mental health.

Boosted Confidence and Financial Discipline

Accomplishing financial goals can also boost your confidence and self-esteem. When you set realistic goals and achieve them, you build a sense of accomplishment and belief in your abilities. This, in turn, can enhance your financial discipline as you continue to set and reach new goals, creating a positive cycle of success.

Strategies for Setting and Achieving Financial Goals

Setting SMART Financial Goals:

Setting SMART financial goals is crucial for success. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. When setting financial goals, make sure they are clear, quantifiable, realistic, relevant to your financial situation, and have a deadline for completion.

Creating an Action Plan

To work towards your financial goals effectively, it is essential to create a detailed action plan. Here are some tips for creating an action plan:

- Break down your goals into smaller, manageable tasks.

- Assign specific tasks to each goal with deadlines.

- Create a budget to track your progress and allocate funds accordingly.

- Identify potential obstacles and develop strategies to overcome them.

Regular Review and Adjustment

Regularly reviewing and adjusting your financial goals is key to staying on track. It allows you to assess your progress, make necessary changes, and ensure you are still aligned with your long-term objectives. By reviewing and adjusting your goals, you can adapt to any changes in your financial situation and stay focused on achieving success.