Diving into the Impact of credit scores on loans, this introduction sets the stage for a deep dive into the world of credit scores and their influence on loan applications. Get ready to uncover the secrets behind credit scores and loans in a way that’s both informative and intriguing.

Exploring the intricate relationship between credit scores and loans opens up a world of possibilities and challenges that many borrowers face.

Importance of Credit Scores

Having a good credit score is crucial when applying for a loan as it serves as a measure of your creditworthiness. Lenders use this score to assess the risk of lending money to you and determine the terms of the loan.

Impact on Loan Approval Decisions

Your credit score plays a significant role in whether your loan application gets approved or denied. A higher credit score indicates responsible financial behavior and makes you a more attractive borrower to lenders. On the other hand, a low credit score can lead to rejection of your loan application.

Affect on Loan Terms and Interest Rates

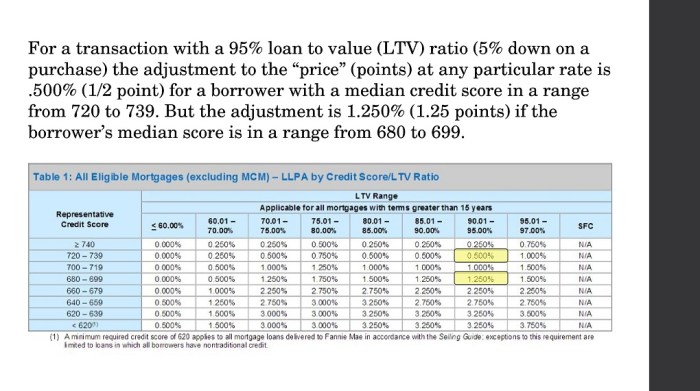

When you have a good credit score, you are more likely to secure a loan with favorable terms such as lower interest rates and higher loan amounts. Conversely, a poor credit score may result in higher interest rates, stricter repayment terms, and lower loan amounts. For example, a borrower with an excellent credit score may qualify for a mortgage with a 3% interest rate, while someone with a lower score might be offered the same loan at a 6% interest rate.

Factors Affecting Credit Scores

Maintaining a good credit score is crucial for securing favorable loan terms and financial opportunities. Various factors play a significant role in determining an individual’s credit score, influencing their creditworthiness and financial standing.

Payment History

A crucial factor in determining credit scores is an individual’s payment history. Timely payments on credit accounts, loans, and bills contribute positively to one’s credit score, reflecting responsible financial behavior. On the other hand, late payments, defaults, and delinquencies can significantly lower credit scores, signaling potential risk to lenders.

Credit Utilization

Credit utilization ratio, the amount of credit being used compared to the total available credit, is another key factor impacting credit scores. High credit utilization, especially above 30%, can negatively affect credit scores as it suggests a higher risk of financial strain. Maintaining a low credit utilization ratio demonstrates responsible credit management and positively influences credit scores.

Credit History

Credit history, the length of time an individual has held credit accounts, also plays a crucial role in determining credit scores. A longer credit history with a track record of responsible credit usage can boost credit scores, showcasing a stable financial background. Conversely, limited credit history or a history of negative credit events can lower credit scores, indicating potential risk to lenders.

Credit Inquiries and Types of Credit Accounts

Credit inquiries, such as applications for new credit accounts or loans, can impact credit scores. Multiple hard inquiries within a short period can lower credit scores, as it may indicate financial distress or high-risk behavior. Additionally, the types of credit accounts held, such as revolving credit (credit cards) or installment loans (mortgages, auto loans), can influence credit scores differently based on the individual’s credit management and payment history.

Relationship Between Credit Scores and Loan Approval

Maintaining a good credit score is crucial when it comes to loan approval. Lenders heavily rely on credit scores to determine the risk associated with lending money to individuals. A higher credit score typically indicates a lower risk borrower, making it more likely for them to secure a loan with favorable terms.

Credit Score Requirements for Different Types of Loans

- For conventional mortgages, a credit score of at least 620 is usually required, but a higher score may lead to better interest rates.

- FHA loans typically have lower credit score requirements, with some lenders accepting scores as low as 500 with a larger down payment.

- Personal loans may vary in their credit score requirements, but generally, a score above 660 is considered good for competitive rates.

How Lenders Assess Borrowers’ Creditworthiness

Lenders use credit scores as a tool to evaluate borrowers’ creditworthiness. A higher credit score indicates responsible credit management and a lower likelihood of defaulting on a loan. Lenders may also consider other factors such as income, employment history, and debt-to-income ratio when making lending decisions. However, credit scores play a significant role in determining the terms of the loan and the interest rate offered to borrowers.

Impact of Credit Scores on Loan Terms

When it comes to borrowing money, credit scores play a crucial role in determining the terms of the loan. Lenders use credit scores to assess the risk associated with lending money to an individual, which ultimately affects the loan terms offered.

Credit Scores and Interest Rates

One of the most significant impacts of credit scores on loan terms is the interest rate. Borrowers with higher credit scores are typically offered lower interest rates, while those with lower credit scores may face higher interest rates. This is because a higher credit score is viewed as an indicator of lower risk, making the borrower more attractive to lenders.

Loan Amounts Based on Credit Scores

Another way credit scores influence loan terms is through the loan amount offered. Borrowers with higher credit scores are more likely to qualify for larger loan amounts, while those with lower credit scores may be limited in the amount they can borrow. Lenders are more willing to extend larger loans to individuals with strong credit histories, as they are seen as more likely to repay the loan.

Improving Credit Scores for Better Loan Terms

It’s essential for borrowers to understand that improving their credit scores can lead to better loan terms and conditions. By taking steps to boost their credit score, such as making on-time payments, reducing debt, and monitoring their credit report for errors, borrowers can increase their chances of qualifying for loans with lower interest rates and higher loan amounts.