Get ready to dive into the world of stock investments with our guide on how to invest in stocks. From understanding the basics to building a diversified portfolio, this article will equip you with the knowledge needed to kickstart your investing journey. So, let’s explore the exciting realm of stocks together!

Understanding Stock Investments

Investing in stocks means buying ownership in a company, giving you a share in its profits and losses. It’s a way to potentially grow your money over time by participating in the success of businesses.

Benefits of Investing in Stocks

- Potential for high returns: Stocks have historically provided higher returns compared to other investments like bonds or savings accounts.

- Diversification: Investing in a variety of stocks can help spread out risk and protect your portfolio from market fluctuations.

- Liquidity: Stocks can be easily bought and sold, giving you the flexibility to access your money when needed.

Risks Associated with Stock Investments

- Market Volatility: Stock prices can fluctuate significantly in the short term, leading to potential losses if you sell during a downturn.

- Company-specific Risks: Individual stocks can be affected by factors like poor management decisions, industry trends, or competitive pressures.

- Loss of Capital: There is always a risk of losing your initial investment if the stock price declines and you sell at a loss.

Types of Stocks to Invest In

When it comes to investing in stocks, it’s important to understand the different types available. Each type of stock has its own characteristics and factors to consider before making investment decisions.

Growth Stocks:

Growth stocks are shares of companies that are expected to grow at a faster rate than the average market. These companies typically reinvest their earnings into expanding their business rather than paying dividends to shareholders. Investing in growth stocks can be more volatile but offers the potential for high returns.

Value Stocks:

Value stocks are shares of companies that are considered undervalued by the market. These companies may have strong fundamentals but are priced lower than their intrinsic value. Value stocks are often found in stable industries and are seen as a safer investment compared to growth stocks. Investors looking for long-term growth potential with lower risk often turn to value stocks.

Dividend Stocks:

Dividend stocks are shares of companies that pay out a portion of their profits to shareholders in the form of dividends. These stocks are popular among investors looking for regular income streams. Dividend stocks are often from well-established companies with stable earnings and can provide a steady source of passive income.

Factors to Consider When Choosing Stocks to Invest In:

– Company Financials: Look at the company’s revenue, earnings growth, debt levels, and cash flow to assess its financial health.

– Industry Trends: Consider the industry the company operates in and how it may be affected by market trends or economic conditions.

– Risk Tolerance: Determine your risk tolerance and investment goals to align with the type of stocks you choose to invest in.

– Diversification: Spread your investments across different types of stocks to reduce risk and maximize returns.

How to Start Investing in Stocks

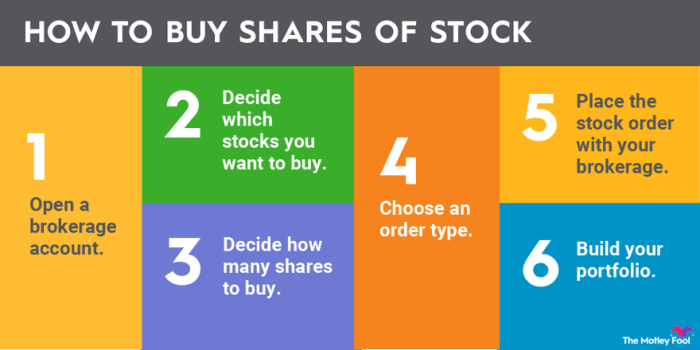

Investing in stocks can be a great way to build wealth over time. If you’re ready to get started, here are the steps you need to take:

Opening a Brokerage Account

When it comes to investing in stocks, the first step is to open a brokerage account. This is where you’ll buy and sell stocks. Here’s how to do it:

- Research different brokerage firms to find one that fits your needs.

- Fill out an application with your personal information and financial details.

- Deposit funds into your account to start investing.

Researching and Selecting Individual Stocks

Before you start investing in individual stocks, it’s important to do your research. Here’s how to research and select the right stocks for your portfolio:

- Look at the company’s financial health and performance.

- Consider the company’s growth potential and industry trends.

- Check the company’s valuation and stock price to determine if it’s a good investment.

Placing Stock Orders

Once you’ve selected the stocks you want to invest in, it’s time to place your stock orders. Here’s how the process works:

- Decide whether you want to place a market order or a limit order.

- Enter the stock symbol and the number of shares you want to buy or sell.

- Review and confirm your order before submitting it.

Building a Diversified Portfolio

Diversification is a key strategy in stock investing that involves spreading your investments across different assets to reduce risk. By diversifying your portfolio, you can potentially minimize the impact of a single stock’s performance on your overall investment.

Examples of How to Build a Diversified Stock Portfolio

- Invest in stocks from various sectors such as technology, healthcare, consumer goods, and finance. This helps reduce the impact of a downturn in one specific sector.

- Consider investing in both domestic and international stocks to diversify your geographic exposure.

- Include a mix of large-cap, mid-cap, and small-cap stocks to balance risk and return potential.

- Add bonds, real estate investment trusts (REITs), or other asset classes to further diversify your portfolio beyond just stocks.

Benefits of Spreading Investments Across Different Sectors and Industries

- Diversification can help protect your portfolio from significant losses during market downturns, as not all sectors or industries will be affected in the same way.

- It can potentially increase your chances of capturing gains from different sectors that are performing well at different times.

- By diversifying, you can lower the overall volatility of your portfolio, making it more stable and less susceptible to extreme fluctuations.

Monitoring and Managing Investments

Investing in stocks is not a one-time activity. It requires constant monitoring and management to ensure that your portfolio is performing as expected and to make adjustments as needed.

Significance of Monitoring Stock Investments

Monitoring your stock investments is crucial to track the performance of your portfolio and make informed decisions. By keeping a close eye on your investments, you can identify any trends or patterns that may impact your returns.

Tools and Resources for Tracking Stock Performance

- Stock Market Websites: Websites like Yahoo Finance, Bloomberg, and CNBC provide real-time stock quotes, news, and analysis to help you track the performance of your investments.

- Investment Apps: Apps like Robinhood, TD Ameritrade, and E*TRADE offer mobile platforms that allow you to monitor your portfolio on the go.

- Financial News Channels: Channels like CNBC and Bloomberg TV provide up-to-date information on market trends and stock performances.

Strategies for Managing a Stock Portfolio Effectively

- Diversification: Spread your investments across different sectors and industries to reduce risk and increase the potential for returns.

- Regular Rebalancing: Periodically review and adjust your portfolio to ensure it aligns with your investment goals and risk tolerance.

- Stay Informed: Keep yourself updated on market trends, economic indicators, and company news to make informed decisions about your investments.

Understanding Market Trends and Analysis

Investing in stocks requires a keen understanding of market trends and analysis to make informed decisions. Analyzing market trends and stock performance is crucial to identify potential investment opportunities and mitigate risks. Let’s delve into the role of fundamental and technical analysis in stock investments, along with tips on interpreting financial news and data for investment decisions.

Role of Fundamental and Technical Analysis

Fundamental analysis involves evaluating a company’s financial health, including revenue, earnings, growth potential, and competitive position in the market. Investors use this analysis to determine the intrinsic value of a stock and assess its long-term viability. On the other hand, technical analysis focuses on studying past market data, such as price movements and trading volume, to forecast future price trends. By analyzing charts and patterns, investors can identify potential entry and exit points for trades.

Interpreting Financial News and Data

To make informed investment decisions, it’s essential to interpret financial news and data accurately. When reading news articles or financial reports, pay attention to key metrics such as earnings per share (EPS), revenue growth, and profit margins. Look for trends or patterns that may impact the stock’s performance in the short or long term. Additionally, consider the broader economic landscape and how external factors like interest rates, inflation, and geopolitical events can influence market trends.