Yo, listen up! Financial yield calculation is where it’s at. Get ready to dive into the world of numbers and investments like never before.

This is where we break down the concept, types, factors, methods, and applications of financial yield calculation in a way that’s easy to understand and totally rad.

Introduction to Financial Yield Calculation

Financial yield calculation is a crucial aspect of investment analysis that helps investors assess the profitability of an investment over time. By determining the yield of an investment, investors can make informed decisions about where to allocate their funds and how to diversify their portfolios.

Importance of Financial Yield Calculation

- It allows investors to compare the returns from different investment options.

- Helps in evaluating the performance of an investment relative to its risk.

- Enables investors to forecast future income streams and make strategic investment decisions.

Key Factors in Financial Yield Calculation

- Interest Rates: The prevailing interest rates play a significant role in determining the yield of an investment.

- Time Horizon: The length of time an investor plans to hold an investment impacts the yield calculation.

- Investment Risk: Higher-risk investments typically offer higher yields to compensate for the increased risk.

- Income Streams: Different types of investments generate income in various ways, affecting the overall yield.

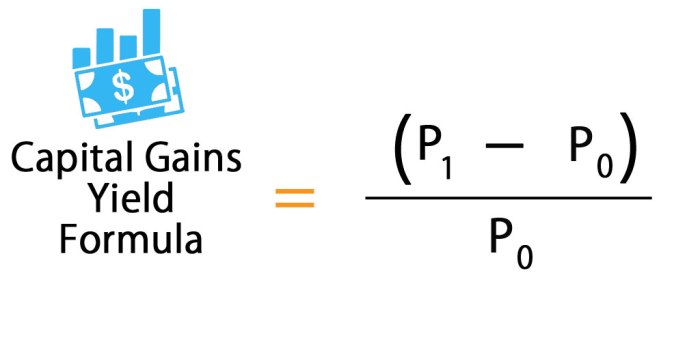

Types of Financial Yield

When it comes to calculating financial yield, there are different types that serve various purposes in the world of finance. These include current yield, yield to maturity, and yield to call.

Current Yield

Current yield is a simple calculation that measures the annual income an investment generates relative to its current market price. This type of yield is often used for bonds and is calculated using the following formula:

Current Yield = (Annual Interest Payment / Current Market Price) x 100%

For example, if a bond pays $50 in annual interest and is currently trading at $1,000, the current yield would be 5% (($50 / $1,000) x 100%).

Yield to Maturity

Yield to maturity is a more comprehensive measure that takes into account the total return an investor can expect if they hold a bond until it matures. This type of yield considers both the annual interest payments and any capital gains or losses upon maturity. The calculation for yield to maturity is more complex and often requires the use of financial calculators or software.

For example, if an investor purchases a bond for $900 with an annual interest payment of $50 and holds it until maturity where they receive $1,000, the yield to maturity would be calculated based on these cash flows over the life of the bond.

Yield to Call

Yield to call is similar to yield to maturity but focuses on the return an investor would receive if a bond is called by the issuer before it reaches maturity. This type of yield is important for callable bonds where the issuer has the option to redeem the bond before the maturity date.

The calculation for yield to call involves considering the call date, call price, and potential call premium. It is essential for investors to understand this type of yield to make informed decisions about callable bonds.

Overall, each type of financial yield serves a specific purpose in evaluating the return on investment for different financial instruments, providing investors with valuable insights into their potential earnings and risks.

Factors Affecting Financial Yield Calculation

When calculating financial yield, there are several key factors that can have a significant impact on the outcome. These factors include interest rates, market conditions, and credit ratings, all of which play a crucial role in determining the final yield on an investment.

Interest Rates

Interest rates have a direct impact on financial yield calculations. When interest rates rise, the yield on an investment typically increases, as investors are able to earn a higher return on their money. Conversely, when interest rates fall, the yield on an investment may decrease. For example, if you have a bond with a fixed interest rate of 5% and market interest rates rise to 6%, the yield on your bond will be less attractive to investors, leading to a decrease in its value.

Market Conditions

Market conditions, such as overall economic stability, inflation rates, and investor sentiment, can also affect financial yield calculations. In times of economic uncertainty or high inflation, investors may demand higher yields to compensate for the increased risk. This can lead to a decrease in bond prices and a higher yield. On the other hand, during periods of economic growth and stability, yields may be lower as investors are more confident in the market.

Credit Ratings

Credit ratings play a crucial role in determining the yield on fixed-income securities. Higher credit ratings indicate lower risk, which translates to lower yields. Conversely, lower credit ratings signal higher risk, leading to higher yields to compensate for the increased chance of default. For example, a bond issued by a company with a AAA credit rating will generally have a lower yield compared to a bond from a company with a junk rating.

These factors interact in complex ways to determine the financial yield on an investment. By understanding how interest rates, market conditions, and credit ratings impact yield calculations, investors can make more informed decisions when evaluating potential investments.

Methods of Financial Yield Calculation

When it comes to calculating financial yield, there are various methods that can be used to determine the return on an investment. Two common methods include the bond yield formula and the dividend yield formula. These formulas are essential tools for investors to assess the profitability of their investments accurately.

Bond Yield Formula

The bond yield formula is used to calculate the return on a bond investment. It takes into account the bond’s price, face value, coupon rate, and time to maturity. The formula is as follows:

Bond Yield = (Annual Interest Payment + ((Face Value – Current Price) / Years to Maturity)) / Current Price

- Step 1: Determine the bond’s annual interest payment by multiplying the coupon rate by the face value of the bond.

- Step 2: Calculate the bond’s current price in the market.

- Step 3: Find out the number of years remaining until the bond matures.

- Step 4: Plug the values into the bond yield formula to calculate the yield.

Dividend Yield Formula

The dividend yield formula is used to measure the annual dividend income generated by an investment relative to its current market price. It is a crucial metric for evaluating the income potential of stocks. The formula is as follows:

Dividend Yield = (Annual Dividends per Share / Price per Share) x 100

- Step 1: Determine the annual dividends per share paid by the company.

- Step 2: Find out the current market price per share of the stock.

- Step 3: Plug the values into the dividend yield formula to calculate the yield.

Accuracy and consistency in yield calculation methods are paramount for making informed investment decisions. By using these formulas correctly and consistently, investors can assess the performance and profitability of their investments accurately, enabling them to make sound financial choices.

Applications of Financial Yield Calculation

Financial yield calculation plays a crucial role in various investment decisions, especially when dealing with financial instruments like bonds, stocks, and real estate. Investors rely on yield calculations to assess the potential returns and risks associated with different investment options. Let’s delve into the practical applications of financial yield calculation and how it aids investors in making informed decisions.

Real Estate Investments

Investors often use financial yield calculation to evaluate the profitability of real estate investments. By calculating the yield, investors can determine the potential rental income compared to the property’s purchase price. This helps in assessing the overall return on investment and making decisions on whether to proceed with the real estate purchase.

Bonds

When it comes to bonds, financial yield calculation is essential for determining the effective yield that an investor will receive from holding a bond until maturity. By considering factors like the bond’s coupon rate, current market price, and time to maturity, investors can calculate the yield to maturity (YTM) to assess the bond’s profitability and compare it with other investment options.

Stocks

In the stock market, financial yield calculation is used to evaluate the dividend yield of a stock, which indicates the dividend income relative to the stock price. Investors can analyze the dividend yield along with other financial metrics to assess the overall return potential of a stock and make decisions on whether to invest in a particular company.

Case Studies

Case studies provide real-world examples of how financial yield calculations are applied in investment strategies. For instance, a case study could demonstrate how an investor used yield calculations to choose between two bonds with different coupon rates and maturities. By comparing the yields of both bonds, the investor can make an informed decision based on the potential returns and risks associated with each bond.