Get ready to dive into the world of credit score recovery tips where we uncover the secrets to rebuilding your financial reputation. From understanding the importance of a good credit score to practical strategies for improving it, this guide has got you covered. So, grab your notebooks and let’s get started on this journey to financial success!

Importance of Credit Score Recovery

Having a good credit score is crucial for various financial opportunities. It is a measure of your creditworthiness and can impact your ability to secure loans, mortgages, credit cards, and even job opportunities.

Negative Impact of Low Credit Score

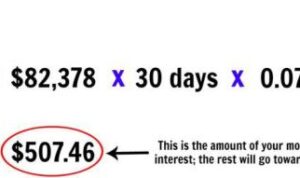

- A low credit score can result in higher interest rates on loans, making borrowing more expensive.

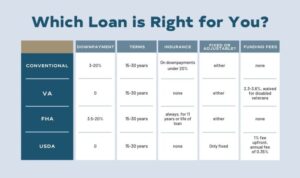

- It can lead to difficulty in getting approved for new credit accounts or loans.

- A bad credit score may limit your ability to rent an apartment or secure a mortgage.

- Employers may check credit scores during the hiring process, and a poor credit history could impact your job prospects.

Understanding Credit Scores

Credit scores are numerical representations of an individual’s creditworthiness, indicating the likelihood of repaying borrowed money. Lenders, such as banks and credit card companies, use these scores to evaluate the risk of lending money to a particular individual.

What is a Credit Score?

A credit score is a three-digit number that ranges from 300 to 850, with higher scores indicating better creditworthiness. It is based on the information in your credit report, including your payment history, amount of debt, length of credit history, new credit accounts, and types of credit used.

How are Credit Scores Calculated?

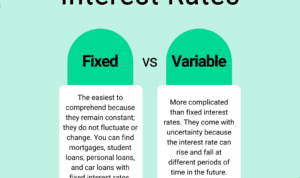

Credit scores are calculated using a mathematical algorithm that analyzes the information in your credit report. The most commonly used credit scoring model is the FICO score, which takes into account the following factors:

- Payment History: Accounts for 35% of your credit score, reflecting whether you have paid your bills on time.

- Amounts Owed: Makes up 30% of your score, indicating the total amount of debt you owe compared to your credit limits.

- Length of Credit History: Makes up 15% of your score, showing how long you have been using credit.

- New Credit: Accounts for 10% of your score, reflecting how many new accounts you have opened recently.

- Credit Mix: Makes up 10% of your score, considering the different types of credit accounts you have, such as credit cards, mortgages, and loans.

Factors that Influence a Credit Score

- Payment History: Your track record of making on-time payments.

- Amounts Owed: The total amount of debt you owe.

- Length of Credit History: How long you have been using credit.

- New Credit: The number of new credit accounts you have opened recently.

- Credit Mix: The variety of credit accounts you have, such as credit cards and loans.

Tips for Improving Credit Score

Paying bills on time, keeping credit card balances low, and monitoring credit reports regularly are essential strategies to improve your credit score.

Paying Bills on Time

- Set up automatic payments or reminders to ensure you never miss a due date.

- Pay at least the minimum amount due on time to avoid late fees and negative marks on your credit report.

- Consider enrolling in electronic statements to receive notifications promptly.

Keeping Credit Card Balances Low

- Avoid maxing out your credit cards as it can negatively impact your credit utilization ratio.

- Try to keep your credit card balances below 30% of your available credit limit.

- Consider making multiple payments throughout the month to keep balances low.

Monitoring Credit Reports Regularly

- Check your credit report from all three major credit bureaus (Equifax, Experian, TransUnion) at least once a year.

- Look for any errors or discrepancies and report them to the credit bureau for correction.

- Consider signing up for credit monitoring services to receive alerts of any changes to your credit report.

Rebuilding Credit after Financial Setbacks

After experiencing financial setbacks like bankruptcy, it’s important to take proactive steps to rebuild your credit. By understanding the impact of missed payments on credit scores and learning how to negotiate with creditors, you can start the journey towards improving your credit health.

Steps to Take for Recovering from Bankruptcy

- Review your credit report to ensure all information is accurate.

- Create a budget to manage your finances effectively.

- Start rebuilding credit with a secured credit card or credit-builder loan.

- Make all payments on time to demonstrate responsible financial behavior.

- Consider seeking the help of a credit counselor for guidance.

Impact of Missed Payments on Credit Scores

- Missed payments can significantly lower your credit score.

- They stay on your credit report for up to seven years.

- Repeated missed payments can lead to further damage to your credit health.

- It’s crucial to prioritize making timely payments to avoid negative repercussions.

Methods for Negotiating with Creditors to Improve Credit

- Contact your creditors to discuss payment options or settlement agreements.

- Explain your financial situation and propose a feasible repayment plan.

- Consider enrolling in a debt management program to consolidate and repay debts.

- Seek professional help from a credit counseling agency for negotiation assistance.

Seeking Professional Help

Seeking professional help from credit counseling services or credit repair companies can be beneficial in your journey to improving your credit score. These professionals have the expertise and resources to guide you through the process of credit score recovery.

Benefits of Credit Counseling Services

- Provide personalized financial advice and budgeting strategies.

- Negotiate with creditors on your behalf to lower interest rates or create repayment plans.

- Offer educational resources to help you better understand credit and financial management.

Credit Repair Companies Assistance

- Identify errors on your credit report and dispute inaccuracies with credit bureaus.

- Help you develop a plan to pay off outstanding debts and improve your credit utilization ratio.

- Monitor your credit report regularly to track your progress and make adjustments as needed.

Tips for Choosing a Reputable Credit Repair Service

- Research and read reviews from other customers to gauge the company’s reputation.

- Avoid companies that promise quick fixes or guarantee specific results, as these can be red flags for scams.

- Ensure the company is accredited and has certified credit counselors or specialists on staff.