Get ready to dive into the world of Credit score improvement with a fresh perspective, where we break down complex concepts into easy-to-understand nuggets of wisdom.

Let’s explore the ins and outs of credit scores, from understanding the calculations to mastering strategies for boosting your score.

Understanding Credit Scores

A credit score is a numerical representation of an individual’s creditworthiness, which is used by lenders to assess the likelihood of the person repaying their debts. It is calculated based on various factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries.

Importance of Having a Good Credit Score

Your credit score plays a crucial role in determining your ability to secure loans, credit cards, mortgages, and other financial products. A higher credit score can result in better interest rates, higher credit limits, and more favorable terms, saving you money in the long run.

Factors Influencing a Credit Score

- Payment History: Timely payments on credit accounts are essential for a good credit score.

- Credit Utilization: Keeping credit card balances low relative to credit limits is important.

- Length of Credit History: The longer your credit history, the better it reflects your credit management skills.

- Types of Credit Used: Having a mix of credit accounts (credit cards, loans, mortgage) can positively impact your score.

- New Credit Inquiries: Opening multiple new credit accounts within a short period can lower your score.

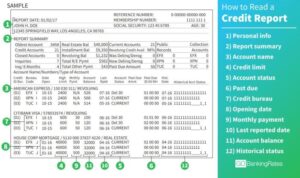

Tips on How to Check Your Credit Score

It is crucial to regularly monitor your credit score to ensure accuracy and identify any potential issues. You can check your credit score for free through various online platforms, credit bureaus, or financial institutions. Review your credit report for any errors and take steps to address them promptly to maintain a healthy credit score.

Strategies for Improving Credit Scores

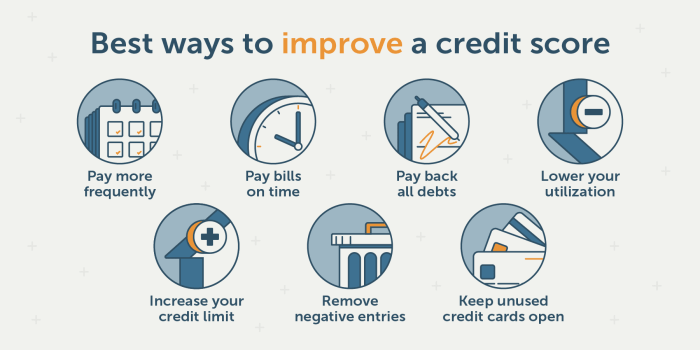

Improving your credit score is essential for accessing better financial opportunities. Here are some effective strategies to boost your credit score:

Timely Payments

One of the most crucial factors in improving your credit score is making timely payments on all your credit accounts. Late payments can significantly impact your score negatively.

Credit Utilization

Another key element in enhancing your credit score is maintaining a low credit utilization ratio. Aim to keep your credit card balances below 30% of your available credit limit to show responsible credit management.

Credit Monitoring

Regularly monitoring your credit report can help you identify any errors or fraudulent activities that could be dragging down your score. By staying vigilant, you can take quick action to rectify any issues and improve your credit standing.

Common Mistakes to Avoid

When it comes to improving your credit score, there are certain common mistakes that you need to avoid in order to prevent negatively impacting your financial health. These mistakes can have serious consequences on your credit score and can hinder your efforts to improve it.

Missing Payments

- Missing credit card or loan payments can have a significant negative impact on your credit score.

- Consequences include late fees, increased interest rates, and a lower credit score.

- To rectify this mistake, make sure to set up automatic payments or reminders to ensure you never miss a payment again.

Maxing Out Credit Cards

- Utilizing all of your available credit can signal to lenders that you may be financially irresponsible.

- This can lead to a decrease in your credit score and make it harder to secure loans or credit in the future.

- To avoid this mistake, aim to keep your credit utilization below 30% of your available credit limit.

Closing Old Accounts

- Closing old credit accounts can shorten your credit history and lower the average age of your accounts.

- This can negatively impact your credit score, as it may appear that you have less experience managing credit.

- If you have old accounts that you no longer use, consider keeping them open to maintain a longer credit history.

Building Credit History

Building a positive credit history is crucial for financial success. Lenders use your credit history to determine your creditworthiness, which can impact your ability to get loans, credit cards, or even secure housing or employment.

Establishing a Credit History

- Open a secured credit card: A secured credit card requires a cash deposit, making it easier to qualify for individuals with no credit history.

- Become an authorized user: Being added as an authorized user on someone else’s credit card can help you build credit without the responsibility of making payments.

- Take out a credit-builder loan: These loans are designed to help individuals establish a positive payment history.

Types of Credit Accounts

- Revolving Credit: Credit cards are the most common type of revolving credit. They allow you to borrow up to a certain limit and make monthly payments.

- Installment Credit: Loans with fixed payments over a set period, like auto loans or mortgages, help diversify your credit mix.

Good Credit-Building Practices

- Pay bills on time: Timely payments show lenders that you are reliable and can manage credit responsibly.

- Keep credit utilization low: Aim to use less than 30% of your available credit to maintain a healthy credit utilization ratio.

- Monitor your credit report: Regularly check your credit report for errors and address any discrepancies promptly.