Get ready to dive into the world of compounding interest, where money grows like a high school gossip rumor, compounding over time to create wealth beyond your wildest dreams. Brace yourself for a rollercoaster ride through the realm of finance as we uncover the secrets behind this magical phenomenon.

In the following paragraphs, we will break down the formula, explore different compounding frequencies, emphasize the importance of time, and reveal real-life applications that will leave you inspired to start your own journey towards financial prosperity.

Introduction to Compounding Interest

Compounding interest is a powerful concept in finance that allows your money to grow exponentially over time. It involves earning interest on both the initial principal amount and the accumulated interest from previous periods.

Unlike simple interest, which is calculated only on the principal amount, compounding interest reinvests the interest earned back into the investment, resulting in higher returns over the long term.

The Power of Compounding Interest

- Imagine you invest $1,000 in an account with a 5% annual interest rate. After the first year, you would earn $50 in interest, bringing your total to $1,050. In the second year, you would earn 5% interest on $1,050 instead of just $1,000, resulting in $52.50 in interest.

- Over time, this compounding effect continues to grow your money faster, as each year you earn interest on an increasing total amount. After 10 years, your initial $1,000 investment could have grown to over $1,600, showcasing the power of compounding interest.

Formula and Calculation of Compounding Interest

When it comes to calculating compound interest, there is a specific formula that is used to determine the final amount after a certain period of time. Understanding this formula and the variables involved is crucial for making informed financial decisions.

The Formula for Calculating Compound Interest

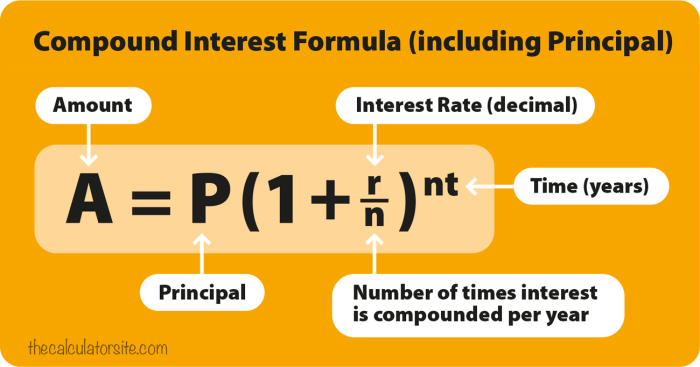

To calculate compound interest, the formula used is:

A = P(1 + r/n)^(nt)

Where:

– A is the amount of money accumulated after n years, including interest.

– P is the principal amount (initial investment).

– r is the annual interest rate (in decimal form).

– n is the number of times that interest is compounded per year.

– t is the time the money is invested for in years.

Variables Involved and Their Impact

The variables in the compound interest formula play a significant role in determining the final amount. Here’s how each variable impacts the calculation:

– Principal Amount (P): The higher the initial investment, the more significant the compound interest earned over time.

– Annual Interest Rate (r): A higher interest rate leads to faster growth of the investment due to compounding.

– Compounding Period (n): The more frequent the compounding, the higher the final amount due to more frequent interest calculations.

– Time (t): The longer the money is invested, the more time it has to grow through compounding.

Step-by-Step Calculation of Compound Interest

To calculate compound interest on an investment, follow these steps:

- Determine the principal amount (P).

- Identify the annual interest rate (r) and the compounding period (n).

- Determine the time (t) the money will be invested for.

- Plug the values into the compound interest formula: A = P(1 + r/n)^(nt).

- Calculate the final amount (A) to see how much the investment will grow over time.

Frequency of Compounding

When it comes to compounding interest, the frequency at which interest is added to the principal can have a significant impact on the final amount. The more often interest is compounded, the more you can potentially earn.

Effect of Different Compounding Frequencies

- Annual Compounding: Interest is added once a year. This is the least frequent compounding option.

- Semi-Annual Compounding: Interest is added twice a year, increasing the frequency of compounding.

- Quarterly Compounding: Interest is added four times a year, allowing for more frequent growth of your investment.

- Monthly Compounding: Interest is added every month, providing even more opportunities for your money to grow.

The more frequently interest is compounded, the more you can potentially earn on your investment.

| Initial Investment | Annual Compounding | Semi-Annual Compounding | Quarterly Compounding | Monthly Compounding |

|---|---|---|---|---|

| $1000 | $1104.71 | $1105.06 | $1105.34 | $1105.61 |

| $5000 | $5523.55 | $5527.50 | $5534.31 | $5541.21 |

| $10000 | $11047.10 | $11054.99 | $11068.62 | $11082.42 |

Importance of Time in Compounding Interest

Investing early and allowing time for compounding interest to work its magic can make a significant difference in building wealth over the long term. The relationship between time and compounding interest is crucial, as the longer your money is invested, the more opportunity it has to grow exponentially.

Benefits of Starting Early

When it comes to investing, starting early can have a massive impact on the growth of your wealth. Let’s consider two individuals, Alex and Sam. Alex starts investing $1,000 per year at the age of 25 and stops at 35, while Sam starts investing $1,000 per year at the age of 35 and continues until retirement at 65. Assuming an annual interest rate of 7%, Alex’s investments will grow significantly more than Sam’s due to the extra years of compounding.

- Alex’s total contributions over 10 years: $10,000

- Sam’s total contributions over 30 years: $30,000

Time is the most powerful factor when it comes to compounding interest. The longer your money is invested, the more it can grow exponentially.

Long-term vs. Short-term Investments

Let’s compare the outcomes of long-term versus short-term investments with compounding interest. Consider two scenarios: one where you invest $5,000 per year for 30 years with an annual interest rate of 8%, and another where you invest $10,000 per year for 10 years with the same interest rate.

- Total contributions in the long-term scenario: $150,000

- Total contributions in the short-term scenario: $100,000

In this example, the long-term investment with lower annual contributions ends up growing significantly more due to the additional time for compounding to work its magic.

Real-Life Applications of Compounding Interest

Compounding interest is not just a theoretical concept; it plays a crucial role in various real-life financial scenarios. Let’s explore how individuals can leverage compounding interest in savings accounts, investments, and retirement funds to secure their financial future.

Utilization in Savings Accounts

In savings accounts, compounding interest allows your money to grow over time as the interest is calculated not only on the initial deposit but also on the accumulated interest. This means that the longer you leave your money untouched, the more it will grow. For example, if you deposit $1,000 in a savings account with a 5% annual interest rate, after one year, you would have $1,050. Over time, the interest will compound, and your savings will continue to increase exponentially.

Utilization in Investments

Compounding interest is a powerful tool in investments as well. By reinvesting the interest earned, you can accelerate the growth of your investment portfolio. For instance, if you invest $5,000 in a mutual fund with a 7% annual return, the compounding effect will help your investment grow significantly over the years. The key is to stay invested for the long term to maximize the benefits of compounding interest.

Utilization in Retirement Funds

Retirement funds, such as 401(k) accounts, heavily rely on compounding interest to build a substantial nest egg for retirement. By consistently contributing to your retirement account and taking advantage of employer matching contributions, you can harness the power of compounding interest to secure a comfortable retirement. The earlier you start saving for retirement, the more time your money has to grow through compounding.