Diving deep into the world of Capital gains tax rates, we explore the ins and outs of how these rates are calculated and their impact on investments. Get ready for a rollercoaster ride of financial knowledge that will leave you feeling like a Wall Street pro!

In this detailed breakdown, we’ll cover everything from short-term to long-term capital gains tax rates, giving you the lowdown on how to navigate the complex world of taxes with style and finesse.

Overview of Capital Gains Tax Rates

Capital gains tax rates refer to the taxes imposed on the profit made from the sale of an investment or asset. These rates are calculated based on the type of asset, the holding period, and the investor’s income tax bracket.

Difference between Short-term and Long-term Capital Gains Tax Rates

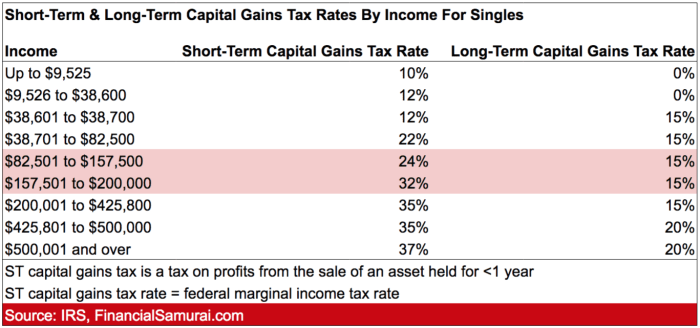

Short-term capital gains tax rates apply to assets held for one year or less, and are taxed at the investor’s ordinary income tax rate. On the other hand, long-term capital gains tax rates are applied to assets held for more than one year, and are usually lower than short-term rates.

Examples of Assets Subject to Capital Gains Tax

- Stocks and bonds

- Real estate properties

- Collectibles such as art, antiques, and precious metals

Impact of Capital Gains Tax Rates on Investments

Capital gains tax rates can influence investment decisions, as investors may consider holding onto assets for longer periods to benefit from lower long-term rates. Additionally, the tax rates can affect the overall return on investment and the after-tax profitability of different assets.

Short-Term Capital Gains Tax Rates

Short-term capital gains tax rates refer to the taxes imposed on profits made from selling assets held for one year or less. These gains are taxed differently than long-term gains, which are gains from assets held for more than one year. Let’s delve into the specifics of short-term capital gains tax rates and how they differ from long-term gains.

Current Short-Term Capital Gains Tax Rates

Short-term capital gains are typically taxed at the individual’s ordinary income tax rate. This means that the rate can vary depending on the individual’s tax bracket. For example, if you fall in the 22% tax bracket, your short-term capital gains will also be taxed at 22%.

Exceptions and Special Rules

There are certain exceptions and special rules related to short-term capital gains tax rates. For example, some assets like collectibles or certain types of investments may have a different tax rate applied to them. It’s important to consult with a tax professional to understand any specific rules that may apply to your situation.

Comparison to Ordinary Income Tax Rates

Short-term capital gains tax rates are typically higher than long-term capital gains tax rates, which are subject to lower rates. This is because the government incentivizes long-term investments by offering lower tax rates on gains from assets held for more than one year. Comparatively, short-term gains are taxed at ordinary income tax rates, which can be significantly higher.

Long-Term Capital Gains Tax Rates

When it comes to long-term capital gains tax rates, they are typically lower than short-term rates, providing an incentive for investors to hold onto their investments for a longer period of time.

Current Long-Term Capital Gains Tax Rates

- The current long-term capital gains tax rates range from 0% to 20%, depending on your income level.

- For individuals in the highest tax bracket, the long-term capital gains tax rate is 20%.

- Those in lower income brackets may qualify for 0% or 15% long-term capital gains tax rates.

Rationale Behind Preferential Treatment

The preferential treatment for long-term capital gains is based on the idea of rewarding investors who take on the risk of holding onto their investments for an extended period. This is seen as a way to encourage long-term investment and economic growth.

Recent Changes or Proposed Reforms

- There have been discussions about potentially increasing the long-term capital gains tax rates for high-income individuals in order to generate more revenue for government programs.

- However, any proposed reforms would likely face opposition from those who argue that higher taxes on long-term capital gains could deter investment and hinder economic growth.

Strategies to Minimize Capital Gains Tax

Minimizing capital gains tax liability is essential for maximizing investment returns. By employing tax-efficient strategies, individuals can reduce their tax burden and retain more of their profits.

Tax-Loss Harvesting

One effective method to reduce capital gains tax is through tax-loss harvesting. This strategy involves selling investments that have incurred losses to offset gains realized from other investments. By strategically timing the sale of these assets, investors can minimize their overall tax liability.

Holding Assets for the Long Term

Another approach to lower capital gains tax is by holding assets for the long term. Investments held for over a year qualify for lower long-term capital gains tax rates, which can significantly reduce the amount owed to the government. By practicing patience and avoiding frequent trading, individuals can take advantage of these lower rates.

Charitable Donations

Charitable donations can also be used as a tax-efficient strategy to minimize capital gains tax. By donating appreciated assets, such as stocks or real estate, individuals can avoid paying capital gains tax on the appreciation while also receiving a tax deduction for the full market value of the donation. This allows investors to support charitable causes while reducing their tax burden.

Importance of Tax Planning

Effective tax planning is crucial in managing capital gains tax rates. By carefully considering the timing of asset sales, holding periods, and charitable giving, individuals can optimize their investments to minimize tax liability. Engaging in proactive tax planning can lead to significant savings and enhanced overall financial outcomes.