How to invest in commodities sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Investing in commodities opens up a world of opportunities for investors looking to diversify their portfolios and explore unique assets beyond traditional stocks and bonds. This guide will take you through the essentials of commodity investment, from understanding the market to choosing the right strategy.

Overview of Commodities Investment

Investing in commodities involves buying and selling raw materials or primary agricultural products with the aim of making a profit. Unlike stocks or bonds, commodities are tangible assets that can be physically delivered.

Types of Commodities

- Metals: Gold, silver, platinum

- Energy: Crude oil, natural gas

- Agriculture: Corn, wheat, soybeans

Reasons for Investing in Commodities

Commodities offer diversification benefits to a portfolio, as they often have low correlation with traditional asset classes like stocks and bonds. They can also act as a hedge against inflation and currency devaluation.

Popular Commodities Examples

- Gold: Considered a safe-haven asset in times of economic uncertainty.

- Oil: Highly traded commodity due to its importance in various industries.

- Agricultural Products: Essential for food production and consumption globally.

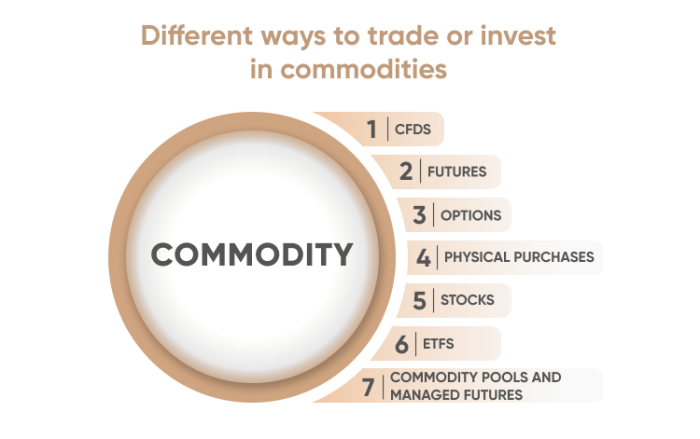

Ways to Invest in Commodities

Investing in commodities can be done through various methods, each with its own set of risks and benefits. It’s important to understand these options and factors to consider when choosing a commodity investment strategy.

Futures

Futures contracts involve buying or selling commodities at a set price for delivery at a future date. This method allows investors to speculate on price movements without owning the physical commodity. The benefits include potential for high returns, but the risks involve leverage and market volatility.

Options

Options give investors the right, but not the obligation, to buy or sell commodities at a predetermined price within a specific time frame. This method offers leverage and limited risk, but it requires a solid understanding of options trading and can result in losses if not used wisely.

Exchange-Traded Funds (ETFs)

ETFs are investment funds traded on stock exchanges that hold a basket of commodities or commodity-related assets. They provide diversification and liquidity, making them a popular choice for investors looking to gain exposure to commodities without directly trading futures or options.

Stocks

Investing in commodity-related stocks of companies involved in the production, exploration, or distribution of commodities is another way to gain exposure to the commodity market. While stocks can offer potential for capital appreciation and dividends, they are also subject to company-specific risks and market fluctuations.

Consider factors such as risk tolerance, investment goals, time horizon, and market conditions when choosing a commodity investment strategy. It’s essential to conduct thorough research, seek advice from financial professionals, and diversify your portfolio to manage risk effectively.

Factors Influencing Commodities Prices

When it comes to commodities prices, there are several key factors that play a significant role in determining their value. Understanding these factors is crucial for anyone looking to invest in commodities successfully.

Global events, such as natural disasters, economic crises, or political instability, can have a major impact on commodity prices. For example, a hurricane in a major oil-producing region can disrupt supply and cause oil prices to spike. Similarly, geopolitical tensions in a key mining country can lead to supply disruptions and price fluctuations.

Supply and demand dynamics are also critical in determining commodity prices. If demand for a particular commodity exceeds supply, prices are likely to rise. Conversely, if supply outstrips demand, prices may fall. This delicate balance between supply and demand is constantly shifting and can be influenced by factors such as weather conditions, technological advancements, or changes in consumer preferences.

Inflation and economic indicators are important considerations when it comes to commodities prices. Commodities are often seen as a hedge against inflation, as their value tends to rise when the purchasing power of fiat currencies declines. Economic indicators, such as GDP growth, interest rates, and unemployment rates, can also impact commodities prices by signaling overall market conditions and investor sentiment.

Impact of Global Events on Commodities Prices

Global events, such as natural disasters, economic crises, or political instability, can have a major impact on commodity prices. For example, a hurricane in a major oil-producing region can disrupt supply and cause oil prices to spike. Similarly, geopolitical tensions in a key mining country can lead to supply disruptions and price fluctuations.

Supply and Demand Dynamics in Commodities Market

Supply and demand dynamics are critical in determining commodity prices. If demand for a particular commodity exceeds supply, prices are likely to rise. Conversely, if supply outstrips demand, prices may fall. This delicate balance between supply and demand is constantly shifting and can be influenced by factors such as weather conditions, technological advancements, or changes in consumer preferences.

Role of Inflation and Economic Indicators in Commodity Prices

Inflation and economic indicators are important considerations when it comes to commodities prices. Commodities are often seen as a hedge against inflation, as their value tends to rise when the purchasing power of fiat currencies declines. Economic indicators, such as GDP growth, interest rates, and unemployment rates, can also impact commodities prices by signaling overall market conditions and investor sentiment.

Diversification with Commodities

When it comes to diversifying an investment portfolio, commodities play a crucial role in spreading risk and enhancing overall returns. By adding commodities to a portfolio, investors can reduce the correlation between different asset classes, providing a buffer against market volatility and economic uncertainties.

Commodities vs Traditional Assets

- Commodities behave differently from traditional assets like stocks and bonds due to their unique market drivers. While stocks and bonds are influenced by factors such as company performance and interest rates, commodities are more directly impacted by supply and demand dynamics.

- For example, the price of oil can be influenced by geopolitical tensions, weather events, and production disruptions, making it less correlated with the performance of stocks and bonds. This lack of correlation can help reduce the overall risk in a portfolio.

Role in Risk Management

- Commodities can act as a hedge against inflation, as their prices tend to rise during times of economic uncertainty or when inflation is high. This can help protect the purchasing power of an investment portfolio in times of rising prices.

- Additionally, commodities like gold are considered safe-haven assets, often gaining value during times of market turmoil or geopolitical unrest. By including such commodities in a portfolio, investors can mitigate risk and reduce overall volatility.