Understanding credit reports sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Get ready to dive deep into the world of credit reports, where financial mysteries are unraveled and secrets are revealed.

What is a Credit Report?

A credit report is a detailed record of an individual’s credit history and financial behavior. It includes information such as the individual’s credit accounts, payment history, credit inquiries, and public records.

Components of a Credit Report

- Credit Accounts: This section lists all the credit accounts a person has, including credit cards, loans, and mortgages.

- Payment History: This shows whether payments have been made on time, late, or missed altogether.

- Credit Inquiries: Records of who has requested a person’s credit report, such as lenders or credit card companies.

- Public Records: This includes any bankruptcies, foreclosures, or tax liens that may impact a person’s creditworthiness.

How Credit Reports are Used

- Lenders: Lenders use credit reports to assess a person’s creditworthiness before approving a loan or credit application.

- Financial Institutions: Banks and financial institutions use credit reports to determine the interest rates and terms they offer to customers.

- Employers: Some employers may check credit reports as part of the hiring process to evaluate a candidate’s financial responsibility.

Importance of Understanding Credit Reports

Understanding credit reports is crucial for individuals to maintain financial health and make informed decisions. Your credit report reflects your financial history, including your payment behavior, debt levels, and credit utilization. Here’s why it’s essential to grasp the ins and outs of your credit report:

Impact on Financial Decisions and Opportunities

- When applying for a loan or credit card, lenders review your credit report to assess your creditworthiness. A good credit report with a high credit score can increase your chances of approval and help you secure better interest rates.

- Employers and landlords may also check your credit report as part of the screening process. A negative report could potentially impact your job prospects or ability to rent a home.

- Understanding your credit report allows you to identify any errors or fraudulent activity that could be dragging down your score. By monitoring your report regularly, you can take steps to correct inaccuracies and protect yourself from identity theft.

Effects of Good or Bad Credit Reports

- A good credit report can open doors to various opportunities, such as qualifying for a mortgage, getting approved for a car loan, or even securing a lower insurance premium. It showcases your financial responsibility and reliability.

- On the flip side, a bad credit report can lead to higher interest rates, limited access to credit, and difficulty obtaining approval for loans or credit cards. It can also impact your ability to rent an apartment or get certain jobs.

- Improving your credit report through responsible financial habits, such as making timely payments and keeping your credit utilization low, can help you build a strong credit profile over time.

How to Obtain a Credit Report

To obtain a free credit report, individuals can follow a few simple steps. It is important to regularly check your credit report to ensure accuracy and identify any potential errors that could impact your financial health.

Different Credit Reporting Agencies and Requesting a Report

- There are three major credit reporting agencies: Equifax, Experian, and TransUnion. Each agency collects and maintains credit information on individuals.

- To request a report from each agency, you can visit their official websites or contact them directly. You are entitled to one free credit report per year from each agency.

- It is recommended to stagger your requests throughout the year, obtaining one report from a different agency every four months. This allows you to monitor your credit more frequently.

Checking Credit Reports for Accuracy and Errors

- Individuals should check their credit reports at least once a year to ensure that all information is accurate and up-to-date.

- Reviewing your credit report regularly can help you detect any errors, such as incorrect personal information, fraudulent accounts, or inaccurate payment history.

- If you find any discrepancies or errors on your credit report, it is important to report them to the respective credit reporting agency and take steps to rectify the issue.

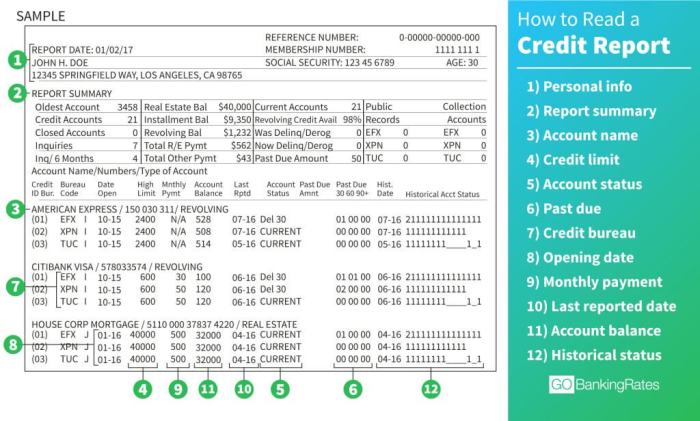

Interpreting a Credit Report

Understanding the different sections of a credit report and deciphering the credit scores provided is crucial for managing your financial health effectively.

Breaking Down the Sections of a Credit Report

- The Personal Information Section: This includes your name, address, social security number, and other identifying details.

- Account Information: Details about your credit accounts, such as credit cards, loans, and payment history.

- Public Records: Any bankruptcies, liens, or judgments that may impact your credit.

- Inquiries: Records of who has accessed your credit report, which can affect your score.

Understanding Credit Scores

- Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

- Factors that influence your credit score include payment history, credit utilization, length of credit history, new credit accounts, and credit mix.

- Monitoring your credit score regularly can help you track your financial progress and identify areas for improvement.

Tips for Interpreting Credit Report Information

- Check for inaccuracies: Ensure all information on your credit report is correct and up-to-date.

- Identify areas for improvement: Focus on paying bills on time, reducing debt, and avoiding opening multiple new accounts.

- Understand the impact of credit inquiries: Limit the number of hard inquiries on your credit report to prevent negative effects on your score.

- Utilize credit monitoring services: Stay informed about changes to your credit report and take proactive steps to maintain or improve your credit score.

Impact of Credit Reports on Financial Health

Having a good credit report is crucial for maintaining a healthy financial status. It can greatly impact your ability to obtain loans, credit cards, and even secure favorable interest rates.

Creditworthiness and Loan Approvals

- Credit reports play a significant role in determining your creditworthiness to lenders. They provide a snapshot of your financial history, including payment history, credit utilization, and account mix.

- Based on the information in your credit report, lenders assess the risk of lending you money. A positive credit report with a high credit score can lead to easier approval for loans and credit.

- Loan approvals are often dependent on the information found in your credit report. Lenders use this data to evaluate your ability to repay borrowed funds.

Maintaining a Healthy Credit Report and Improving Credit Scores

- Regularly monitor your credit report to identify any errors or discrepancies that could negatively impact your credit score.

- Make timely payments on all your credit accounts to demonstrate responsible financial behavior and improve your creditworthiness.

- Keep credit card balances low and avoid maxing out your credit limits, as high credit utilization can lower your credit score.

- Diversify your credit mix by having a combination of credit cards, installment loans, and mortgages to show that you can manage different types of credit responsibly.

- Avoid opening multiple new credit accounts within a short period, as this can lower the average age of your accounts and potentially harm your credit score.