Looking to ditch your student loan debt fast? We’ve got you covered with effective strategies, refinancing options, and budgeting techniques that will have you debt-free in no time. Get ready to take control of your finances and say goodbye to those loans!

In a world where student loan debt seems never-ending, learning how to tackle it head-on is crucial. Let’s dive into the ins and outs of paying off student loans fast and reclaiming your financial freedom.

Strategies for Paying Off Student Loans Quickly

Paying off student loans quickly is a common goal for many individuals looking to achieve financial freedom and stability. By utilizing various methods and strategies, you can accelerate the process and alleviate the burden of student loan debt.

Creating a budget and setting specific financial goals are crucial steps in paying off student loans quickly. This allows you to track your expenses, identify areas where you can cut back, and allocate more funds towards loan repayment. Prioritizing your loan payments ensures that you stay on track and make progress towards becoming debt-free.

List of Different Methods to Pay Off Student Loans Fast:

- Make extra payments whenever possible to reduce the principal amount and interest accrued over time.

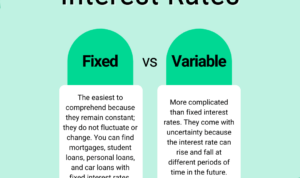

- Consider refinancing your student loans to secure a lower interest rate, potentially saving you money in the long run.

- Explore income-driven repayment plans or loan forgiveness programs to help lower your monthly payments or forgive a portion of your loan balance.

- Utilize windfalls such as tax refunds, bonuses, or gifts to make lump-sum payments towards your student loans.

Importance of Setting Specific Financial Goals:

Setting specific financial goals provides you with a clear roadmap and motivation to pay off your student loans efficiently. Whether it’s paying off a certain amount by a specific date or targeting high-interest loans first, having a plan in place can keep you focused and disciplined in your repayment journey.

Creating a Budget to Prioritize Loan Payments:

A budget helps you track your income and expenses, allowing you to identify areas where you can cut back and allocate more money towards your student loan payments. By setting aside a portion of your income specifically for loan repayment, you can stay organized and ensure that you meet your financial goals.

Tips on Increasing Income for Loan Repayment:

- Look for part-time or freelance opportunities to supplement your income and allocate the additional funds towards your student loans.

- Consider selling items you no longer need or use to generate extra cash for loan repayment.

- Invest in your skills and education to advance your career and potentially earn a higher salary, allowing you to pay off your student loans faster.

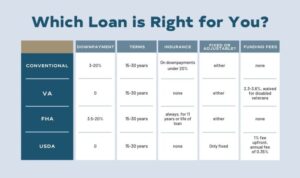

Refinancing and Consolidation Options

When it comes to paying off student loans fast, exploring refinancing and consolidation options can be a game-changer. These strategies can help you save money on interest and streamline your repayment process.

Refinancing involves taking out a new loan with better terms to pay off your existing student loans. This can lower your interest rate, reduce your monthly payments, and potentially save you thousands of dollars over the life of the loan. However, it’s important to consider that refinancing may result in the loss of certain borrower benefits, such as loan forgiveness or income-driven repayment plans.

Benefits and Drawbacks of Refinancing Student Loans

- Benefits:

- Lower interest rates

- Reduced monthly payments

- Potential savings over time

- Drawbacks:

- Loss of borrower benefits

- Potential fees or costs associated with refinancing

- Eligibility requirements may vary

How Loan Consolidation Works

Consolidation involves combining multiple federal student loans into a single loan with a new interest rate and repayment term. This can simplify your monthly payments and potentially lower your interest rate. However, it’s essential to note that you can only consolidate federal student loans, not private loans.

Eligibility Criteria for Refinancing or Consolidating Student Loans

- For refinancing:

- Good credit score (typically 650 or higher)

- Stable income and employment

- Demonstrated ability to repay the loan

- For consolidation:

- Must have federal student loans

- No pending bankruptcy or default status

- Cannot consolidate private loans with federal loans

Potential Risks Associated with Refinancing or Consolidating Student Loans

- Loss of federal borrower benefits

- Longer repayment terms may result in paying more interest over time

- Repayment plans may become less flexible

Budgeting Techniques for Loan Repayment

Managing your finances wisely is key to paying off student loans quickly. By implementing effective budgeting techniques, you can prioritize loan payments and accelerate your path to financial freedom.

Snowball Method for Paying Off Loans

The snowball method involves paying off your smallest loan balances first while making minimum payments on larger loans. Once the smallest loan is paid off, you can roll that payment amount into the next smallest loan. This method builds momentum and motivation as you see progress sooner.

Avalanche Method to Prioritize Loan Payments

The avalanche method focuses on paying off loans with the highest interest rates first. By prioritizing high-interest loans, you can save money in the long run by reducing the amount of interest paid over time. This method is more cost-effective but may take longer to see tangible results compared to the snowball method.

50/30/20 Rule for Loan Repayment

The 50/30/20 rule is a budgeting guideline that suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. By following this rule, you can ensure that a significant portion of your income goes towards paying off student loans, accelerating the repayment process.

Tips for Reducing Expenses to Free Up Money for Loan Payments

– Cut unnecessary expenses such as dining out, subscription services, or shopping for non-essential items.

– Look for ways to save on utilities, groceries, and transportation costs.

– Consider refinancing your loans to lower interest rates and reduce monthly payments.

– Find additional sources of income through part-time work or freelancing to supplement your budget and increase loan repayment funds.

Extra Income Generation Ideas

In addition to your regular job, finding ways to generate extra income can help you pay off your student loans faster. Here are some creative ideas to consider:

Side Hustles vs Second Job

- Side Hustles: Pros – Flexibility to work on your own schedule, potential for higher earnings compared to a traditional part-time job, opportunity to turn a hobby or passion into income. Cons – Income may not be consistent, requires time and effort to build up a client base or customer following.

- Second Job: Pros – Guaranteed income, stable schedule, additional work experience. Cons – Less flexibility, may lead to burnout or decreased productivity in your main job, limited earning potential compared to entrepreneurial ventures.

Tip: Consider your current workload, personal commitments, and financial goals to determine whether a side hustle or a second job is the best option for you.

Investing Extra Income Wisely

- Consider investing in a high-yield savings account or a low-cost index fund to earn passive income.

- Look into peer-to-peer lending platforms or real estate crowdfunding for potentially higher returns.

- Consult with a financial advisor to explore investment options that align with your risk tolerance and financial goals.

Freelancing and Gig Work

- Freelancing: Offer your skills and expertise on platforms like Upwork, Fiverr, or Freelancer to secure short-term projects or ongoing contracts.

- Gig Work: Explore opportunities in the gig economy, such as driving for Uber or Lyft, delivering food with DoorDash or Instacart, or renting out your space on Airbnb.

- Set aside a portion of your freelancing or gig income specifically for loan repayment to accelerate your progress.