Get ready to dive into the world of dollar-cost averaging, where strategic investing meets consistency and growth. This topic is all about making your money work smarter, not harder. So buckle up and let’s explore the ins and outs of this investment strategy that could change the game for you.

Now, let’s break down the concept of dollar-cost averaging and how it can revolutionize your approach to investing.

What is Dollar-Cost Averaging?

Dollar-cost averaging is an investment strategy where an investor regularly buys a fixed dollar amount of a specific investment, regardless of the share price. This approach helps to reduce the impact of market volatility on the overall purchase price.

How Dollar-Cost Averaging Works

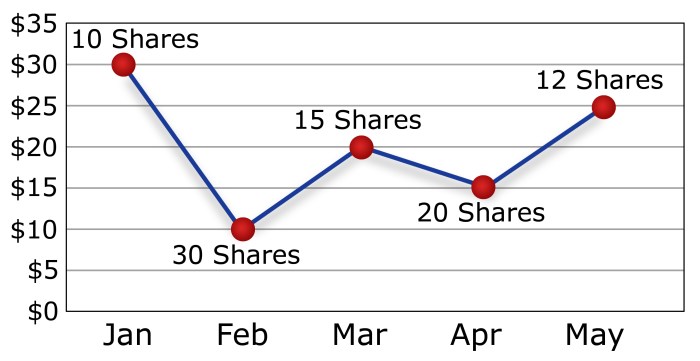

When using dollar-cost averaging, an investor would purchase a set dollar amount of a stock or fund at regular intervals, such as monthly or quarterly. This means that when prices are high, the investor buys fewer shares, and when prices are low, they buy more shares. Over time, this strategy can help to lower the average cost per share.

- For example, let’s say an investor decides to invest $100 every month in a particular stock. In the first month, when the stock price is $50 per share, the investor would purchase 2 shares. In the second month, if the price drops to $25 per share, the investor would buy 4 shares. This averaging out of the purchase price helps to mitigate the impact of market fluctuations.

Benefits of Dollar-Cost Averaging

Dollar-cost averaging offers several advantages as an investment strategy:

- Reduces the risk of making a large investment at the wrong time by spreading out purchases over time.

- Helps to take advantage of market fluctuations, buying more shares when prices are low and fewer when prices are high.

- Disciplines investors to stick to a regular investment plan, promoting long-term wealth accumulation.

- Can be particularly beneficial for volatile markets, as it smooths out the impact of price fluctuations.

Implementing Dollar-Cost Averaging

When it comes to implementing a dollar-cost averaging plan, there are a few key steps to follow to ensure you are investing consistently and effectively.

Setting Up a Dollar-Cost Averaging Plan

- Choose the amount you want to invest regularly: Determine how much you can afford to invest on a regular basis, whether it’s weekly, monthly, or quarterly.

- Select the investment you want to purchase: Decide on the specific investment or investments you want to include in your plan, such as stocks, mutual funds, or ETFs.

- Set up automatic investments: Arrange for automatic transfers from your bank account to your investment account on a regular schedule to ensure consistency.

- Monitor and adjust as needed: Keep track of your investments and adjust your plan as necessary based on your financial goals and market conditions.

Choosing the Right Investment Vehicle

- Consider your financial goals: Determine whether you are investing for short-term gains or long-term growth, and choose investments that align with your objectives.

- Assess risk tolerance: Select investments that match your risk tolerance level, whether you prefer conservative options or are willing to take on more risk for potentially higher returns.

- Diversify your portfolio: Spread your investments across different asset classes to reduce risk and maximize potential returns over time.

- Research investment options: Conduct thorough research on potential investments to ensure they align with your investment strategy and financial objectives.

Automated vs. Manual Dollar-Cost Averaging

- Automated Dollar-Cost Averaging:

- Advantages: Ensures consistency in investing, removes emotions from decision-making, and simplifies the process for busy investors.

- Disadvantages: Limited flexibility in timing purchases, may incur additional fees for automated services, and requires ongoing monitoring.

- Manual Dollar-Cost Averaging:

- Advantages: Allows for more control over investment decisions, flexibility in timing purchases, and the ability to take advantage of market fluctuations.

- Disadvantages: Requires more time and effort to manage investments, can be influenced by emotions, and may lead to inconsistent investing patterns.

Maximizing Dollar-Cost Averaging

Dollar-cost averaging can be a powerful investment strategy when utilized effectively. By following best practices and adjusting your approach based on market conditions, you can maximize the benefits of this method and achieve your financial goals more effectively.

Consistent Investment Schedule

- Stick to a consistent investment schedule to take advantage of market fluctuations over time.

- Regular contributions regardless of market conditions can help average out the cost of investments.

Monitor and Adjust

- Stay informed about market trends and adjust your investment amounts accordingly.

- Consider increasing investments during market downturns to capitalize on lower prices.

Diversification

- Diversify your investments across different asset classes to reduce risk and maximize returns.

- Allocate funds to a mix of stocks, bonds, and other investment options to spread out risk.

Dollar-Cost Averaging vs. Lump Sum Investing

When comparing dollar-cost averaging with lump sum investing, it’s essential to consider the impact on risk and returns. Dollar-cost averaging involves investing a fixed amount of money at regular intervals over time, while lump sum investing entails putting a large sum of money into the market at once.

Dollar-Cost Averaging Outperforming Lump Sum Investing

- Dollar-cost averaging can help mitigate the risk of investing a large sum of money at a market peak, as it spreads out the investment over time.

- By investing consistently over time, dollar-cost averaging allows investors to take advantage of market fluctuations, potentially buying more shares when prices are low.

- It also helps reduce the impact of market volatility on the overall investment portfolio.

Scenarios Favoring Lump Sum Investing

- In situations where the market is on an upward trend, lump sum investing may lead to higher returns compared to dollar-cost averaging.

- If an investor has a large sum of money available and wants to fully capitalize on a potential market upswing, lump sum investing could be advantageous.

- Lump sum investing may be more suitable for investors with a high risk tolerance who are comfortable with market fluctuations.