Get ready to dive into the world of equity investing basics, where the key to financial success awaits. In this guide, we’ll explore the ins and outs of equity investments, from ownership concepts to potential returns, all presented in a way that’s as cool as your favorite high school jam.

So, buckle up and let’s roll through the fundamentals of equity investing together.

Introduction to Equity Investing

Equity investing involves purchasing shares of a company, giving investors ownership in that company. Unlike debt investments, where investors lend money to the company, equity investors become shareholders and have a stake in the company’s success.

Ownership in Equity Investing

In equity investing, owning shares means owning a piece of the company. Shareholders have the right to vote on company decisions, receive dividends if the company is profitable, and benefit from any potential increase in the stock price.

Equity vs. Debt Investments

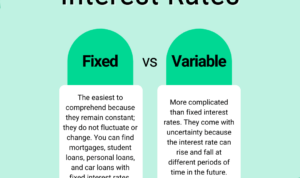

Equity investments provide ownership in a company, while debt investments involve lending money to the company with the expectation of repayment with interest. Equity investors take on more risk but also have the potential for higher returns compared to debt investors.

Popular Equity Investment Vehicles

- Individual Stocks: Investing directly in individual companies by purchasing shares of their stock.

- Exchange-Traded Funds (ETFs): Funds that hold a diversified portfolio of stocks and trade on stock exchanges.

- Mutual Funds: Pooled funds from multiple investors used to invest in a diversified portfolio of stocks managed by professionals.

- Index Funds: Funds that track a specific market index, providing broad exposure to the overall market.

Benefits of Equity Investing

Equity investing offers numerous benefits that can help investors grow their wealth over time. Let’s explore some of the key advantages:

Potential for Higher Returns

Investing in equities provides the potential for higher returns compared to other investment options like bonds or savings accounts. While there is increased risk involved, the opportunity for greater rewards is also significant.

Beating Inflation

Equity investments have historically outpaced inflation rates, allowing investors to maintain the purchasing power of their money over the long term. This can help protect against the erosion of wealth caused by rising prices.

Diversification

By investing in a diverse range of stocks across different sectors and industries, equity investors can reduce their overall risk. Diversification spreads out investment exposure, helping to mitigate losses if one sector underperforms while another excels.

Ownership in Successful Companies

Equity investing offers the opportunity to own shares in successful companies, allowing investors to benefit from the growth and profitability of these businesses. This ownership stake can provide dividends, capital appreciation, and a voice in corporate decision-making.

Risks Associated with Equity Investing

When it comes to equity investing, there are several risks that investors need to be aware of in order to make informed decisions. Let’s dive into some of the key risks associated with equity investments.

Market Volatility as a Risk Factor

Market volatility refers to the erratic and unpredictable nature of price movements in the stock market. This can lead to significant fluctuations in the value of your investments, making it difficult to predict returns accurately. Investors need to be prepared for sudden market downturns or upswings that can impact their portfolio.

Impact of Economic Conditions on Equity Investments

Economic conditions play a crucial role in shaping the performance of equity investments. Factors such as inflation, interest rates, and overall economic growth can influence stock prices. A downturn in the economy can lead to decreased consumer spending, lower corporate profits, and a decline in stock prices.

Geopolitical Events and Equity Markets

Geopolitical events, such as wars, political instability, or trade disputes, can have a significant impact on equity markets. These events can create uncertainty and volatility in the market, causing stock prices to fluctuate rapidly. Investors need to stay informed about global events that could potentially affect their investments.

How to Start Equity Investing

Investing in equity can be a great way to grow your wealth over time, but it’s important to approach it with a plan. Here’s how you can get started on your equity investing journey:

Opening a Brokerage Account

When starting with equity investing, the first step is to open a brokerage account. This account will serve as your gateway to buying and selling stocks. Choose a reputable brokerage firm that offers the tools and resources you need to make informed investment decisions.

Importance of Conducting Research

Before diving into the world of equity investing, it’s crucial to conduct thorough research. This includes analyzing market trends, understanding the fundamentals of different industries, and staying updated on company news. Research helps you make informed decisions and reduces the risk of making hasty investments.

Analyzing Company Fundamentals

When evaluating potential equity investments, it’s essential to analyze the fundamentals of the companies you’re interested in. Look at key financial metrics like revenue growth, earnings per share, and debt levels. Understanding a company’s financial health and growth potential can help you make sound investment decisions.

Creating a Diversified Portfolio

Diversification is key to managing risk in equity investing. By spreading your investments across different sectors and industries, you can reduce the impact of market fluctuations on your portfolio. Aim to create a well-balanced portfolio that includes a mix of large-cap, mid-cap, and small-cap stocks to achieve diversification.