Yo, listen up! You wanna know about investment diversification, right? Well, buckle up ‘cause we’re diving into the world of smart money moves and securing that bag. Get ready for a rollercoaster of financial wisdom that’s gonna up your game.

Now, let’s break it down and see why diversifying your investments is key to making those stacks grow and securing your financial future.

What is Investment Diversification?

Investment diversification is a strategy where an investor spreads their investments across different assets to reduce risk and maximize returns. It involves investing in a variety of asset classes, industries, and geographic regions.

Diversifying investment portfolios is crucial because it helps protect against significant losses that may occur if one asset or market underperforms. By spreading investments, investors can potentially offset losses in one area with gains in another, creating a more stable and balanced portfolio.

Examples of Different Types of Assets for Investment Diversification

- Stocks: Investing in shares of publicly traded companies allows investors to participate in the growth of different industries.

- Bonds: Fixed-income securities provide regular interest payments and can help stabilize a portfolio during market fluctuations.

- Real Estate: Investing in properties or real estate investment trusts (REITs) can offer diversification outside traditional financial assets.

- Commodities: Investing in commodities like gold, silver, oil, or agricultural products can provide a hedge against inflation and economic uncertainty.

- Mutual Funds: These investment vehicles pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

Benefits of Investment Diversification

Investment diversification offers several advantages that can help investors manage risk and potentially improve overall returns.

Reduced Risk

Diversifying investments across different asset classes, industries, and geographical regions can help reduce the overall risk in a portfolio. This strategy ensures that if one investment underperforms or faces a downturn, the impact on the entire portfolio is minimized. By spreading out investments, investors can avoid putting all their eggs in one basket and protect themselves from significant losses.

Improved Returns

While diversification may not guarantee higher returns, it can help optimize the risk-return tradeoff in a portfolio. By including a mix of investments with varying levels of risk and return potential, investors can potentially achieve more stable and consistent returns over the long term. Diversification allows investors to capture opportunities in different market conditions and benefit from the growth of various asset classes.

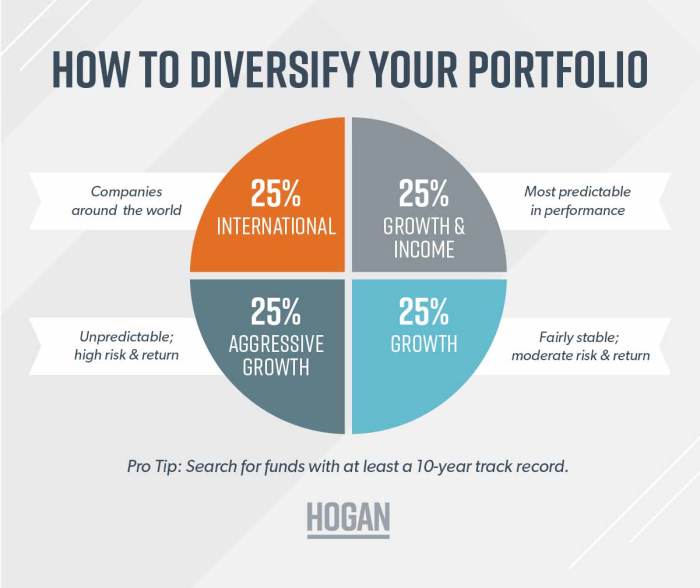

Strategies for Investment Diversification

Diversification is key when it comes to investing your hard-earned money. By spreading your investments across different asset classes, you can reduce risk and potentially increase returns. Let’s dive into some strategies for effective investment diversification.

Asset Allocation

Asset allocation is all about deciding how to divide your investment portfolio among different asset classes like stocks, bonds, real estate, and cash. The goal is to create a mix that aligns with your risk tolerance and financial goals. For example, a young investor with a high risk tolerance might allocate more to stocks for growth potential, while an older investor might lean towards bonds for stability.

Rebalancing

Rebalancing involves periodically adjusting your portfolio back to its original asset allocation. This ensures that your investments stay in line with your goals and risk tolerance. For instance, if stocks have outperformed bonds and now make up a larger portion of your portfolio than intended, you might sell some stocks and buy more bonds to rebalance.

Diversifying Within Asset Classes

Within each asset class, you can further diversify by investing in different sectors or industries. For example, instead of putting all your money in tech stocks, you could spread it across healthcare, energy, and consumer goods. This way, you’re not overly exposed to the performance of a single sector.

Using Investment Vehicles

Different investment vehicles offer unique ways to diversify your portfolio. You can use mutual funds, exchange-traded funds (ETFs), index funds, or even alternative investments like real estate or commodities to achieve diversification. Each vehicle has its own benefits and risks, so it’s important to choose wisely based on your investment goals.

Risks and Considerations

When it comes to investment diversification, there are certain risks to be aware of and important factors to consider in order to effectively manage those risks while maintaining a diversified portfolio.

Common Risks Associated with Investment Diversification

- Diversification does not guarantee profits or protect against losses in a declining market.

- Over-diversification can dilute returns and increase transaction costs.

- Correlation risk, where assets move in the same direction during market fluctuations.

- Liquidity risk, when it is challenging to sell an asset without significantly impacting its price.

Factors to Consider when Diversifying Investments

- Asset allocation based on investment goals, risk tolerance, and time horizon.

- Consideration of market conditions and economic trends.

- Monitoring and rebalancing the portfolio regularly to maintain diversification.

- Assessment of the impact of taxes and fees on investment returns.

Managing Risks while Maintaining a Diversified Portfolio

- Periodic review of the portfolio to ensure it aligns with investment objectives.

- Utilization of different asset classes and investment vehicles to spread risk.

- Implementing stop-loss orders or setting target allocations to control risk exposure.

- Staying informed about market developments and adjusting the portfolio accordingly.