Diving into the world of building wealth through real estate, this introduction sets the stage for an exciting journey filled with lucrative opportunities and smart investment strategies. Get ready to explore the secrets of real estate success!

Introduction to Building Wealth Through Real Estate

Building wealth through real estate involves investing in properties with the goal of generating income and increasing value over time.

Real estate is considered a popular investment vehicle due to its potential for long-term financial growth and stability. Unlike stocks or other investments that can be volatile, real estate generally appreciates in value over time, making it a reliable asset for building wealth.

Long-Term Benefits of Investing in Real Estate

- Appreciation: Real estate properties tend to increase in value over time, allowing investors to build equity and wealth.

- Rental Income: Investing in rental properties can provide a steady stream of passive income, supplementing other sources of revenue.

- Tax Advantages: Real estate investors can benefit from tax deductions, such as mortgage interest, property taxes, and depreciation.

- Diversification: Real estate investments can help diversify a portfolio, reducing overall risk and providing a hedge against market fluctuations.

Types of Real Estate Investments

Residential, commercial, and rental properties are the main types of real estate investments that individuals can consider. Each type offers unique advantages and disadvantages, depending on the investor’s financial goals and risk tolerance.

Residential Properties

Residential properties include single-family homes, condos, townhouses, and multi-family homes. Investing in residential properties can provide a steady rental income, potential for property value appreciation, and tax benefits. However, the main disadvantage is the potential for high turnover rates among tenants, leading to periods of vacancy.

Commercial Properties

Commercial properties consist of office buildings, retail spaces, and industrial complexes. Investing in commercial properties can offer higher rental income potential, longer lease terms, and the opportunity for property value appreciation. On the downside, commercial properties may require higher initial investment costs and can be more susceptible to economic fluctuations.

Rental Properties

Rental properties encompass any real estate investment that involves leasing out the property to tenants. This type of investment can generate passive income for investors, provide tax advantages, and offer long-term wealth-building potential through property appreciation. However, managing rental properties can be time-consuming and may require dealing with tenant issues and property maintenance.

Successful real estate investment strategies within each type can include diversifying the portfolio with a mix of properties, conducting thorough market research before purchasing, and ensuring proper property management to maximize returns.

Financial Planning for Real Estate Investment

Investing in real estate requires careful financial planning to ensure success and maximize returns. Setting clear financial goals, creating a budget, and effectively managing finances are essential steps in building wealth through real estate.

Setting Financial Goals

When investing in real estate, it is crucial to establish specific and achievable financial goals. Whether your goal is to generate passive income, build equity, or achieve long-term growth, clearly defining your objectives will guide your investment decisions and strategies.

Creating a Budget

Before diving into real estate investment, creating a detailed budget is essential. Consider all potential expenses, including property acquisition costs, renovation expenses, property management fees, and ongoing maintenance costs. By accurately estimating your expenses and setting a budget, you can avoid overspending and ensure the profitability of your investments.

Managing Finances Effectively

Effective financial management is key to building wealth through real estate. Keep track of your income, expenses, and cash flow to maintain financial stability and make informed investment decisions. Consider working with a financial advisor or accountant to optimize your financial strategies and maximize returns on your real estate investments.

Real Estate Market Analysis

When it comes to investing in real estate, conducting a thorough market analysis is essential to make informed decisions and maximize profits. By understanding the market trends and factors affecting real estate prices, investors can identify profitable opportunities and mitigate risks.

Identifying Profitable Real Estate Markets

- Research local market conditions: Analyze supply and demand, employment rates, population growth, and economic indicators to determine the health of the real estate market in a specific area.

- Look for growth potential: Identify neighborhoods or cities with upcoming developments, infrastructure projects, or revitalization plans that could lead to increased property values.

- Consider rental demand: Evaluate the rental market in the area by looking at vacancy rates, rental prices, and rental yield to determine the potential for generating passive income.

Key Factors for Analyzing Real Estate Market

- Location: The old saying “location, location, location” holds true in real estate. A prime location with access to amenities, good schools, and transportation can significantly impact property value.

- Market trends: Stay updated on market trends, such as housing inventory, median prices, and days on market, to identify patterns and make informed investment decisions.

- Property type: Consider the type of property you are investing in, whether residential, commercial, or industrial, and evaluate the demand and potential returns for that specific market segment.

- Financial analysis: Conduct a financial analysis to assess the potential return on investment (ROI), taking into account factors like purchase price, renovation costs, rental income, and appreciation potential.

Property Management and Maintenance

Effective property management and regular maintenance are essential aspects of real estate investment to ensure long-term success and profitability. By implementing best practices in property management and prioritizing maintenance, investors can maximize their returns and preserve the value of their assets.

Best Practices for Managing Rental Properties

- Screen potential tenants thoroughly to ensure reliable and responsible occupants.

- Establish clear and detailed lease agreements to protect both parties’ rights and responsibilities.

- Respond promptly to maintenance requests to maintain tenant satisfaction and property condition.

- Regularly inspect the property to identify any issues early on and address them promptly.

- Keep detailed records of income, expenses, and maintenance activities to track the property’s performance.

Importance of Regular Property Maintenance

Regular maintenance is crucial for preserving the value of real estate investments and ensuring the longevity of the property. By addressing maintenance issues promptly, investors can prevent costly repairs and maintain tenant satisfaction, leading to higher occupancy rates and increased rental income.

Tips for Selecting Reliable Property Management Services

- Research and compare different property management companies to find one with a proven track record and positive reviews.

- Inquire about the services offered, including tenant screening, rent collection, maintenance, and financial reporting.

- Discuss fees and contracts upfront to ensure transparency and avoid any hidden costs.

- Ask for references from current clients to get insight into the company’s performance and customer satisfaction levels.

- Select a property management service that aligns with your investment goals and values to establish a successful partnership.

Leveraging Real Estate Investments

When it comes to real estate investing, leveraging is a strategy where you use borrowed funds to increase the potential return on investment. It involves using a small amount of your own money along with borrowed funds to control a larger asset.

Different Ways to Leverage Real Estate Assets

Leveraging real estate assets can be done in various ways to maximize returns:

- Using a mortgage to purchase a rental property and generate rental income that exceeds the mortgage payments.

- Utilizing home equity loans or lines of credit to fund renovations or acquire additional properties.

- Partnering with other investors to pool resources and invest in larger properties that yield higher returns.

Successful Leveraging Strategies in Real Estate Investment

Successful real estate investors have employed leveraging strategies to build wealth:

- Buying properties with low down payments and high potential for appreciation, allowing for a significant return on investment when selling.

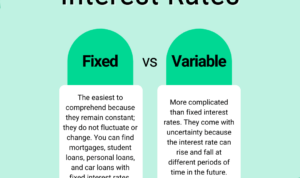

- Refinancing properties to take advantage of lower interest rates and free up equity for additional investments.

- Using 1031 exchanges to defer capital gains taxes and reinvest profits into larger, more profitable properties.