Ready to dive into the world of commodities investing? Buckle up as we explore the ins and outs of this unique investment opportunity that goes beyond traditional stocks and bonds. Get ready to learn how to navigate the exciting world of commodities like a pro!

Introduction to Commodities Investing

Commodities in the investment world refer to raw materials or primary agricultural products that can be bought and sold. These include items like gold, oil, coffee, wheat, and more.

Comparison to Stocks and Bonds

When compared to stocks and bonds, commodities investing has its own unique characteristics. Stocks represent ownership in a company, while bonds are debt securities. Commodities, on the other hand, are physical goods that are traded on exchanges.

- Stocks: Offer ownership in a company and potential dividends.

- Bonds: Represent debt and pay interest over time.

- Commodities: Provide exposure to raw materials and can act as a hedge against inflation.

Commodities tend to have a low correlation with stocks and bonds, making them a valuable addition to a diversified investment portfolio.

Benefits and Risks of Investing in Commodities

Investing in commodities comes with its own set of advantages and risks.

- Benefits:

- Diversification: Commodities can help spread risk in a portfolio.

- Inflation Hedge: Some commodities can retain value during inflationary periods.

- Potential for Profit: Prices of commodities can fluctuate, offering opportunities for gains.

- Risks:

- Volatility: Prices of commodities can be highly volatile, leading to significant losses.

- Market Factors: Changes in supply and demand can impact commodity prices unpredictably.

- Lack of Income: Unlike stocks or bonds, commodities do not typically pay dividends or interest.

Types of Commodities to Invest In

Investing in commodities offers a diverse range of options for investors looking to diversify their portfolios. Here are some examples of different types of commodities and the factors that influence their prices:

Precious Metals

- Gold

- Silver

- Platinum

Precious metals are often used as a hedge against inflation and economic uncertainty.

Energy

- Crude Oil

- Natural Gas

- Electricity

Energy commodities are influenced by geopolitical events, supply and demand dynamics, and weather patterns.

Agriculture

- Wheat

- Corn

- Coffee

Agricultural commodities are impacted by factors such as weather conditions, crop yields, and global demand.

Factors Influencing Commodity Prices

Commodity prices are influenced by a variety of factors including supply and demand dynamics, geopolitical events, weather conditions, government policies, and currency fluctuations. For example, a drought in a major agricultural region can lead to lower crop yields, resulting in higher prices for agricultural commodities.

Hard Commodities vs. Soft Commodities

Hard commodities refer to natural resources that are mined or extracted from the earth, such as metals and energy products. Soft commodities, on the other hand, include agricultural products that are grown, such as grains and livestock. The key difference between the two is the source of the commodity and the way it is produced.

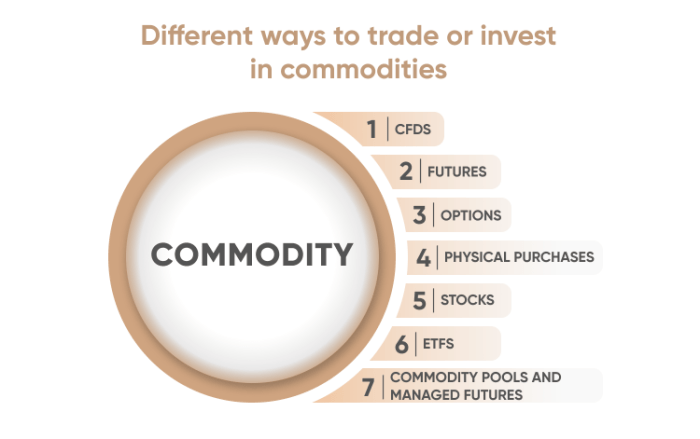

Ways to Invest in Commodities

Investing in commodities can be done through various vehicles, each with its own set of pros and cons. Whether you choose to invest directly in physical assets or use commodity-linked instruments, it’s essential to understand the different options available to you.

Investment Vehicles for Commodities

- Futures Contracts: These are agreements to buy or sell a specific quantity of a commodity at a predetermined price on a future date. Futures contracts are popular among traders looking to profit from price fluctuations in commodities.

- ETFs (Exchange-Traded Funds): These funds invest in a basket of commodities or commodity-related securities, providing investors with exposure to a diversified portfolio without the need for direct ownership of physical assets.

- Physical Assets: Investing directly in physical commodities such as gold, silver, oil, or agricultural products involves owning the actual commodity, either through purchasing it outright or through storage facilities.

Direct vs. Commodity-Linked Instruments

- Direct Investment: Investing directly in commodities can provide a hedge against inflation and diversify your portfolio. However, it requires knowledge of the specific commodity market and may involve storage costs and liquidity issues.

- Commodity-Linked Instruments: These instruments, such as ETFs or mutual funds, offer easier access to commodity markets and allow for diversification without the need for physical ownership. However, they may not provide the same level of direct exposure to commodity price movements.

Popular Commodity Investment Strategies

- Long-Only Strategy: Investors buy and hold commodities with the expectation of price appreciation over time, benefiting from rising commodity prices.

- Commodity Index Investing: Investors track commodity price movements using indexes like the S&P GSCI or DJ-UBS, gaining exposure to a broad range of commodities.

- Managed Futures: This strategy involves investing in futures contracts through a professional manager, aiming to profit from both rising and falling commodity prices.

Factors to Consider Before Investing in Commodities

When entering the commodities market, there are several key factors that investors should consider to make informed decisions. Geopolitical events, economic indicators, and portfolio diversification play crucial roles in shaping the outcome of a commodities investment.

Geopolitical Events and Economic Indicators Impact

Geopolitical events such as wars, conflicts, trade agreements, and natural disasters can significantly impact commodity prices. For example, political instability in oil-producing countries can lead to supply disruptions, causing oil prices to rise. On the other hand, economic indicators like GDP growth, inflation rates, and unemployment levels can also influence commodity prices. A healthy economy often leads to increased demand for commodities, driving prices up.

Importance of Diversification

Diversification is essential in a commodities investment portfolio to spread risk and maximize returns. By investing in different types of commodities across various sectors, investors can reduce the impact of price fluctuations in any single commodity. For instance, a portfolio that includes both precious metals like gold and industrial commodities like copper can help balance out the overall performance.

Risks Associated with Commodities Investing

Investing in commodities comes with its own set of risks that investors need to be aware of. These risks can vary depending on the type of commodity being traded, market conditions, and other factors. It is essential to understand these risks before diving into commodities investing to make informed decisions.

Volatility in Prices

Commodities prices can be highly volatile, influenced by factors such as supply and demand, geopolitical events, weather conditions, and economic indicators. This volatility can lead to sudden price fluctuations, resulting in potential losses for investors.

Leverage and Margin Calls

Leverage is commonly used in commodities trading to amplify potential returns. However, it also amplifies risks. When using leverage, investors borrow funds to increase their trading position. If the market moves against them, they may face margin calls, requiring them to deposit additional funds or risk having their positions liquidated.

Lack of Liquidity

Some commodities markets may lack liquidity, making it difficult to buy or sell positions at desired prices. This illiquidity can lead to wider bid-ask spreads and increased trading costs, impacting overall returns.

Market and Regulatory Risks

Commodities markets are subject to various risks, including regulatory changes, political instability, and market manipulation. These external factors can significantly impact commodity prices and investor portfolios.

Tips for Managing Risks

- Diversify your portfolio by investing in a mix of commodities to spread risk.

- Set stop-loss orders to limit potential losses in case prices move against your positions.

- Stay informed about market news, trends, and events that can affect commodity prices.

- Avoid over-leveraging your positions to reduce the risk of margin calls and potential losses.

- Consider using risk management tools such as options or futures contracts to hedge against price fluctuations.